Fund away from Family and friends How they Functions and also the Expected Papers

Money out of Friends and family: The first port off require borrowing currency to own startups try friends. Typically, promissory notes has acted once the a variety of actually provided currency. They go back again to the ancient Chinese dynasties and you will were introduced in order to European countries of the Marco Polo.

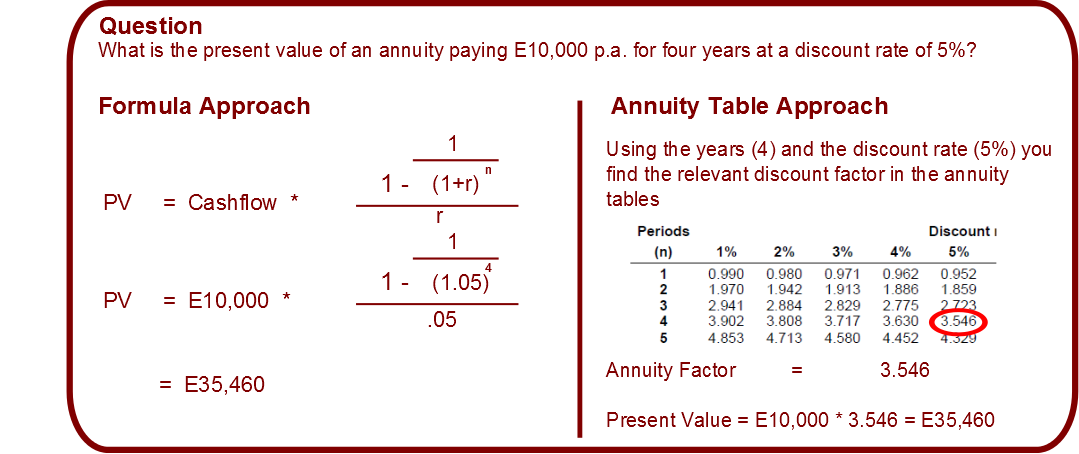

The image off to the right try from a great promissory mention of the next Bank of your All of us in 1840. They are not therefore very any more and certainly will getting simply published data, correctly signed involving the parties.

Funds off friends and family are undoubtedly the biggest chunk of startup funds following the founder’s very own capital or signature loans. One to data place the ratio at the 38% of all startup money. No matter what the newest proportion try, its indeed extremely extreme.

Promissory Notes getting Finance of Friends and family

When you’re relationship are adequate to have the support, the actual purchase away from loans out of relatives and buddies have to be done properly, or you will not just damage the business, however, tough, you’ll undermine the individuals matchmaking. Should you choose obtain from relatives and buddies, then procedure is pretty straightforward. You will need to set up a great promissory notice to put it down in a lawfully joining means for both parties. The borrowed funds will be safeguarded (facing a valuable asset) otherwise unsecured.

Loans off Friends-Record

- brand new events toward financing, the quantity while the interest;

- regards to repayment-periodic: typical wide variety over the identity and additionally capital and focus; balloon: normal degrees of faster size with a massive terminal percentage; lump sum payment: all capital and you will attention at label;

- people charge getting later repayments and in what way he is so you can getting addressed;

- in which and how money will be made;

- punishment (or perhaps not) to possess early payment;

- what takes place in the case of standard into the financing;

- combined and several liability;

- amendment procedure (when the concurred or otherwise not);

- transferability of the financing;

100 % free Promissory Mention Layouts

Prefer or personalize good promissory note that suits you and you may if you possess the tiniest hesitance throughout the signing, manage they by your attorney. Discuss the standards with the both parties for the finance from household members and you will family, before you commit to go ahead. You can get 100 % free layouts away from:

Having a startup you can even choose a convertible promissory cards to have loans regarding friends and family. They can be appealing to those people who are not personal people of your own members of the family or higher loved ones off relatives than your buddies. Instance loan providers may prefer to enjoys a way to take part in brand new upside of the venture. The brand new modifiable promissory notes is actually modifiable to your security from the an afterwards big date, dependant on leads to such as brand https://paydayloanalabama.com/opelika/ of quantities of revenue otherwise funds being hit.

To pay such more fingers length buyers on chance it is actually bringing, this new notes offered usually are modifiable for a cheap price into the price of another prominent security round and also will have an excellent cap’ otherwise a max conversion process speed-towards the rates from which the brand new note will later on move.

Convertible cards are often desirable to both business owners and dealers, because it’s so very hard to put a respect on what is called a beneficial pre-money (ahead of outside money and you will/otherwise ahead of trade indicates a credibility)

Crowdfunding-an alternative choice to Fund off Friends

There are many paths so you’re able to investment a business besides fund out of friends and family. They really want a bit more than while making phone calls. Widely known is to apply crowdfunding, sometimes having fun with advantages otherwise collateral crowdfunding. Benefits crowdfunding pertains to your when you look at the a countless business functions and you can choosing what type of prize you could promote.

Security crowdfunding is quite other, while requesting loans relatives and buddies (and perhaps some individuals that you don’t know actually) to make an investment, in lieu of giving you a gift (perks crowdfunding), or and make that loan that might be paid off, when it concerns repaying interest or perhaps not. We have written about collateral crowdfunding and you can brought a short list from security crowdfunding systems. Have a look.