First-day homebuyers you prefer a reliable real estate professional, a knowledgeable lender, and you will a thorough household inspector

Domestic hunting inside the Phoenix should be aggressive, therefore that have a proper means is key. Consumers has to start from the evaluating communities, given activities for example proximity be effective, colleges, and you will business. They want to attend unlock households and you may plan viewings to have characteristics you to definitely meet its requirements and you may budget.

Carrying out a want to a number of need to-haves and you can bargain-breakers normally streamline the procedure. Enjoyable the best realtor always Phoenix also provide understanding on business trends and you will this new posts. Using on the internet platforms to trace listings and see rates styles is additionally be of good use.

And then make a deal and you can Deals

Once a suitable house is discovered, and work out an aggressive provide ‘s the step two. Consumers have to works closely and their realtor so you can dictate a reasonable promote rates. This calls for evaluating similar transformation in the area, known as comps, knowing the fresh property’s market value.

Settling words like closing costs, fingers timelines, and you may contingencies falls under this action. Brand new representative have a tendency to share anywhere between events to-arrive a collectively agreeable offer. Are versatile and receptive can help into the maintaining a flaccid negotiation techniques, in the course of time resulting in a profitable pick agreement.

Strengthening The Homeownership Cluster

Getting into the journey so you can homeownership within the Phoenix, AZ, demands strengthening a reputable class. For every plays a vital role within the making certain the procedure goes smoothly.

Finding a representative

To own earliest-day homebuyers, a skilled agent are going to be invaluable. It assist come across homes that suit funds and you may lives needs. A real estate agent accustomed new Phoenix town provides facts for the communities and you may possessions viewpoints.

When selecting a representative, believe its feel and track record. Ask questions regarding their knowledge of new Area 32 Homeownership System into the Phoenix. Also, it is helpful to look for suggestions or read feedback to ensure they are aware the crucial thing for a first household.

Understanding the Role out of Loan providers

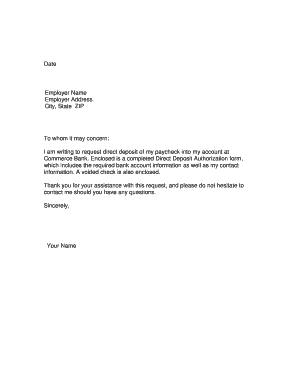

A loan provider instructions the credit processes, enabling consumers secure the best home loan you’ll. Its required to examine loan providers to find favorable loan terms. A loan provider used to guidance applications such as those supplied by brand new Washington Service regarding Houses also have more assistance.

First-big date buyers should know selection for example fixed-price mortgages otherwise deposit guidance. This type of choices makes homeownership much more accessible. Unlock communication into financial ensures understanding of terminology and you may improves depend on in the act.

The necessity of a property Inspector

Property inspector handles consumers by pinpointing possible circumstances for the a good possessions prior to get. It conduct thorough inspections of the residence’s build and you will expertise. This new inspector’s results assist consumers stop high priced fixes down-the-line.

Choose an enthusiastic inspector having a strong reputation, making certain they realize practical inspection practices. Good review is tell you vital information regarding what need resolve otherwise renegotiation. This task is vital getting making sure believe on the purchase of a primary-go out client’s primary household.

Gaining Sensible Homeownership

The journey to reasonable homeownership from inside the Phoenix payday loans online Arkansas begins with knowing the some homebuyer direction applications. Such apps tend to offer financial help for example down payment guidelines. For example, software including the Arizona Was House Program render beneficial service so you’re able to very first-time homebuyers.

Qualifying for those programs typically comes to meeting particular income standards. Of a lot apps need people to make from the otherwise less than a specific part of the area Median Money (AMI). The metropolis out of Phoenix also provides assist with those who fulfill these requirements, aiming to build land more available to lowest and moderate-income parents.

Outlying parts inside the Arizona will benefit off novel software. Brand new Arizona Company from Housing will bring home loan help with beneficial conditions to those to find into the designated outlying portion, providing increase homeownership options.