Toward rate hikes briefly paused into the 2024, together with Dollars Speed carrying constant at the cuatro

- Mortgage Articles

- Rate of interest Predictions Australia

The Set-aside Lender out-of Australia (RBA) might have been and then make waves, modifying the money Speed a few times due to the fact 2022 to combat ascending inflation. Which, needless to say, has actually an impression to your property owners and those looking to purchase property, with focus towards the mortgage loans closely associated with the money Speed.

In this post, we see pro and you may bank forecasts to understand more about what the upcoming you will hold for your requirements due to the fact a borrower otherwise resident, as well as the greater savings. Masters is separated towards RBA’s next move.

We are going to also glance at the fresh new RBA’s present Dollars Rate movements, reflecting the way they keeps advanced responding to different economic conditions.

Recent Bucks Rate Moves

- : The COVID-19 pandemic results in an archive-reasonable Bucks Rate away from 0.10%, designed to trigger the newest benefit.

- , towards the Cash Rate ascending so you can 0.35% due to rising inflation.

- : Rising prices surges to 5.1%, prompting good 0.50-percentage-section increase to 1.35%.

- : The speed is at 3.35%, out of a reduced out-of 0.85% inside .

- : A short pause towards the Bucks Price carrying loans Spanish Fort AL from the 4.10%.

- : Cash Rate retains at 4.35% once a number of grows.

Which historical picture features how the RBA adjusts their procedures mainly based towards the economic climate. We could observe rates fell substantially in the globally economic drama and how they’ve been elevated to combat inflation in the past several years.

The newest pandemic introduced another type of spin as well. Prices had been cut in order to a record low in 2020 to strengthen the brand new benefit. But not, by the 2022 and you may 2023, rising cost of living try a pressing question. The RBA responded with some seven rate nature hikes, pressing the cash Rate from the lowest out-of 0.10% within the . This new increase, in , further emphasised the RBA’s dedication to preventing rising prices, also amidst in the world uncertainties.

The newest recent rate hikes are part of the brand new RBA’s ongoing competition facing rising prices. Given that coming may seem a small undecided today, understanding the RBA’s strategies and their possible affect your bank account makes it possible to make advised decisions for your house mortgage and you will overall economic better-are.

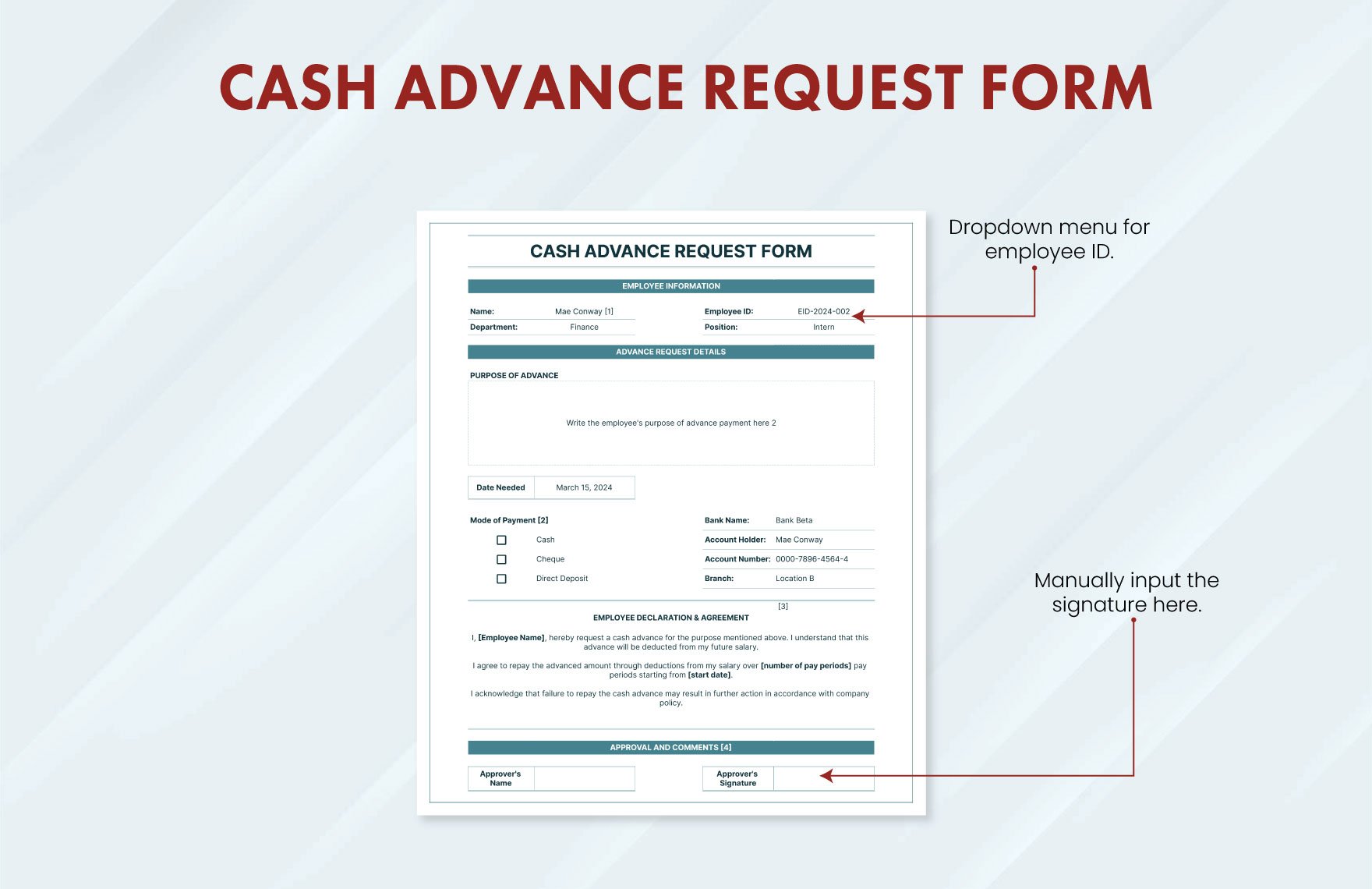

And that Interest To repay To own?

Disclaimer: As soon as possible, you get most guides so you’re able to in your homebuying excursion. Sporadically, you’ll receive meticulously curated family-purchasing tips, also offers & systems, and news content. You might unsubscribe should you require. Have a look at the Privacy

Forecasts In the Big Five Banks

Here is a breakdown of precisely what the Larger Four banking institutions ANZ, Commonwealth Financial, Federal Australia Financial (NAB), and you can Westpac is forecasting on the peak Dollars Price in addition to timing away from potential future slices:

All biggest financial institutions agree totally that new height rates will remain 4.35%; although not, they differ into the whenever and just how easily this may come down.

ANZ is considered the most upbeat how soon the interest rate often go lower, predicting a decline to 3.60% because of the mBank, NAB, and you will Westpac desired a slowly refuse, with costs paying as much as 3.10% towards the end regarding 2025. This type of variations probably come from different viewpoints about quick the new RBA’s speed nature hikes commonly chill inflation and invite getting speed slices.

Regardless, this means that in the event that you try a debtor, you need to predict high mortgage rates for a time, possibly postponing investing and financial increases.

In depth Prediction By the Gurus

I believe we have been nevertheless deciding on between one to and about three additional money Speed develops by the end from the calendar year.

My reasoning for it is that inflation continues to be not close the new focused band the new RBA desires. Specifically, we’re watching ongoing increases into the rents (because of our housing scarcity and you may high immigration). We have brand new income tax incisions arriving July, that may lay more income toward everyone’s purse (permitting them to spend more). At exactly the same time, we haven’t viewed unemployment boost significantly yet ,, which is a routine indicator one to expenses often slow (just like the somebody clean out work, he’s got less money to pay).