It was one to ninety % of your own financing from these style of lenders into the 1996 were nonpurchase money financing

I then examined the new 1996 HMDA studies. This was a different sort of shape that really stressed myself. That means that ninety % of your borrowers, if you set those numbers to one another, was basically probably in their house in advance of they grabbed from the loan which is finish when you look at the foreclosure following losing their property.

NCRC do argue that if you find yourself subprime financing does play a part inside the growing access to borrowing from the bank and investment for those which have blemished borrowing facts, I wish to state exactly what effects me because the form of interested inside the experiencing a number of the authorities and you can prior to individuals whom affirmed

The final point I want to create are exactly how difficult it were to get the research and come up with this research. We version of examine my character just like the an academic to include investigation in order for Congress and other personal plan institutions helps make decisions, but mining the details on SEC filings try the only method of getting it. Therefore i encourage Congress to amend HMDA to make certain that we are able to extremely give what is going on in this industry.

Among severe problems that enough therapists is actually enjoying try anyone coming in that have fund which might be refinanced within a higher level that has zero benefit to the fresh borrower once the the other loan is at a diminished price.

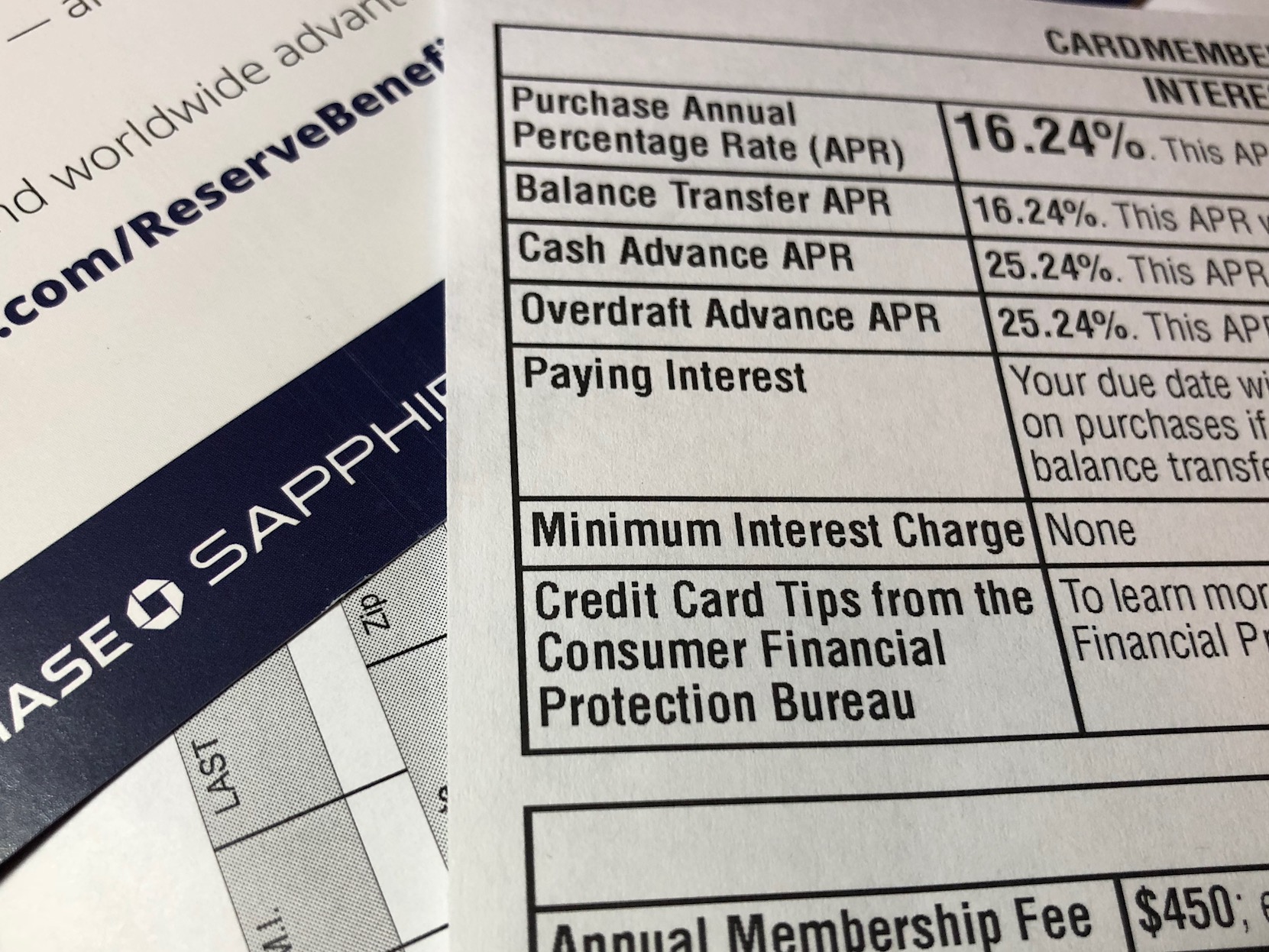

I would like to see such things as that was the interest rate with the financing which was refinanced

Which are the affairs and charge? I wish to inform you of issues and costs. There isn’t any source for information regarding facts and costs best now.

In advance of looking at John Taylor, i’ll just tell I’m such as for example appreciative of your providing statistics so you’re able to bear with this quite difficult topic.

Mr. TAYLOR. Thanks for appealing this new National Community Reinvestment Coalition to attend this hearing. It is good to see Affiliate LaFalce, Member Waters, Member Schakowsky and User Watt and also the other distinguished People in this committee.

We have experienced the biggest jump in lending so you can lowest-earnings and you may modest-money Americans in home control in order to minorities at that time of your time out-of 1992 so you’re able to 1993. Indeed discover a fifty percent increase in credit so you can African-Us americans and Hispanics 24 months consecutively.

Surprisingly, the brand new subprime market at the time is minimal, almost advance cash loan Indiana nonexistent. In those days, we once had things entitled ”affordable housing lending.” I did not have getting so it subprime type of lending circumstances where a primary financial or bank simply claims, ”You don’t precisely match the fresh profile, whatever you are going to carry out try recommend you or recommend visit the monetary institution.”

We do have to inquire our selves what have the CRA regulated establishments carried out in the fresh new refinance loan sector? Enjoys they abandoned such portion? Are reasonable financial loans, branches, income services outreach and kinds of items that heretofore, simply five years in the past, reached this type of populations, were there factors nevertheless available due to the fact finest, maybe not subprime products?

We version of contrast the need for which reading and you can statutes to the struggle we’d in seeking features minorities disperse regarding the right back of your bus into front side of bus. They got us 7 years to successfully pass anyone Renting regulations and truthfully, so it Congress cannot take per year to respond to predatory lending methods. I’m not willing to take on the notion this Congress never need which towards the schedule and extremely try to citation specific rules that forbids these kinds of usury and you can horrible methods that are essentially dispossessing people from their houses.