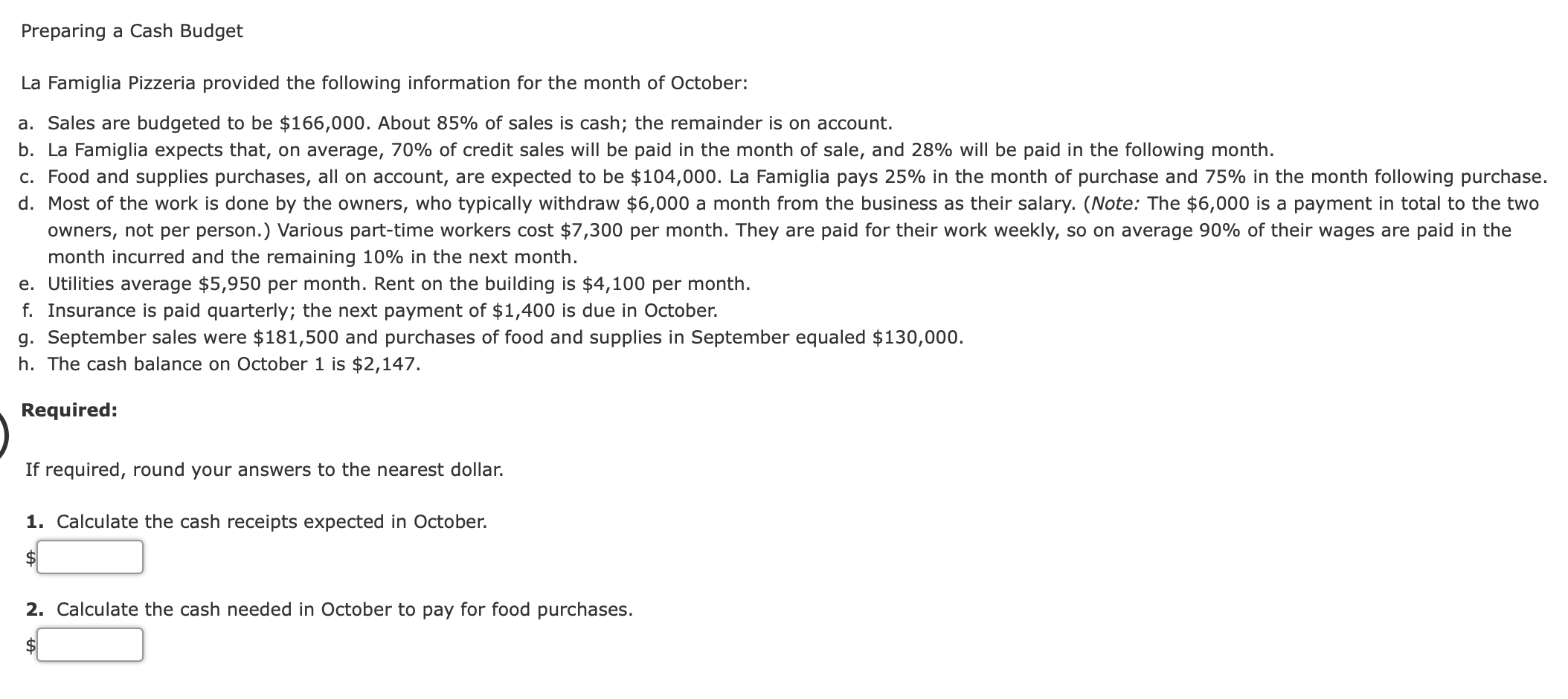

How can you Rating home financing to the a small Domestic?

Go out Published:

Small belongings are all this new anger today. With an increase of anyone trying to downsize the lives, such little domiciles was well-known among home owners and you may tenants alike. However, one of the biggest obstacles that lots of anybody face when trying to find a little house is how they will be able to finance they. On this page, we’ll talk about some different ways you should use and work out your perfect come true!

Let’s financial institutions such mortgages into the little belongings?

Financial institutions give cash on mortgages in line with the value of the fresh new fundamental safety. Put differently, they are aware a home towards the a paragraph will probably be worth, say, $800,000 now. They will thus lend 80%, possibly 90%, in these features. The issue that have small house is because they are incredibly simple to get rid of. The financial institution has no make certain the small domestic they financing now might be there tomorrow. You to definitely higher vehicle can also be dump a $50k-$200k investment on property.

Commonly garages without difficulty removable? Banking institutions often finance them.

This is a good point. Garages was a simple structure which could, in principle, be easily got rid of. The primary variations is one to smaller property are often to your rims ie; they are made to be easily gone whereas garages are repaired in order to a concrete mat. In theory, any house is easy to remove anytime but there is however a serious challenge so you’re able to deleting something plumbed into the and connected with a real mat.

If i connected it in order to a real pad, manage the financial institution consider it then?

It’s still impractical that financial institutions will like to cover a great small house, whether or not it is associated with a concrete pad for similar reason why banking companies wanted an effective fifty% put having short accommodations (significantly less than forty square yards). The truth is simply a small % of one’s inhabitants can also be live in a small domestic. Once your family relations begins to develop, located in 30 rectangular yards will get an issue. This makes it difficult for the financial institution to sell for people who dont pay the financial so that the lender is quite exposure-averse towards the entire circumstances.

How can i rating a mortgage having a small house?

There have been two an effective way to buy a small household make use of the collateral on your own part or score a consumer loan.

Banking institutions usually usually give doing 80% of worth of a part that has resources attached to it. So if you individual a part that’s valued on $500,000 but merely owe $300,000 (60% LVR), you could potentially obtain a different $100,000 (meaning an entire home loan from $400,000 otherwise 80%) and get a little house. Financial institutions perform see so it acceptable while the even although you eliminated the small family, might nonetheless merely are obligated to pay 80% of remaining part.

Delivering a consumer loan was a somewhat more pricey choice. This type of loans aren’t very secure against anything and so the notice price tends to be higher (7%-9%) in addition to mortgage label is faster (5-7 age). However, that is an alternative should your financial is not prepared to provide a mortgage on your section.

Can i score one another a personal bank loan and you may a home loan towards the my part?

Sure, this is certainly you’ll. You might borrow around 80% in your section and just have the remainder number with the an individual financing. Make an effort to make financial alert to so it individual mortgage (specifically exactly what the repayments could well be) so they can component that to your expenditures however,, when you yourself have enough earnings, or perhaps the loan are quick enough, it really should not be an issue.

You will need to check with your Solicitor for your right circumstances but it is our faith that you can if you find yourself going to inhabit the tiny household. You’d receive the First Household Offer when you find the point while would need to provides a bid to own good smaller domestic build (you know the total cost was below the newest price cap towards the offer).

Commonly banks believe smaller land afterwards because they feel very popular?

The challenge you to banking institutions possess having smaller homes ie; they are easily removable will likely imply that tiny property commonly previously heavily preferred because of the the bank even if it be increasingly popular. not, if you buy a part following keep it for some time (give it time to build within the well worth), they should often be in a position to lend up to a relatively significant number of your worth of the fresh new area payday loans in Denver. Help date develop the worth of the point and that will finance your following acquisition of a small family.

Financial Lab’s mission is to be the new digital town rectangular to own economic decision-suppliers to achieve information about their most recent and you can coming home loan. Follow united states with the Fb and you may LinkedIn otherwise sign up for all of our publication getting informed of your newest stuff.