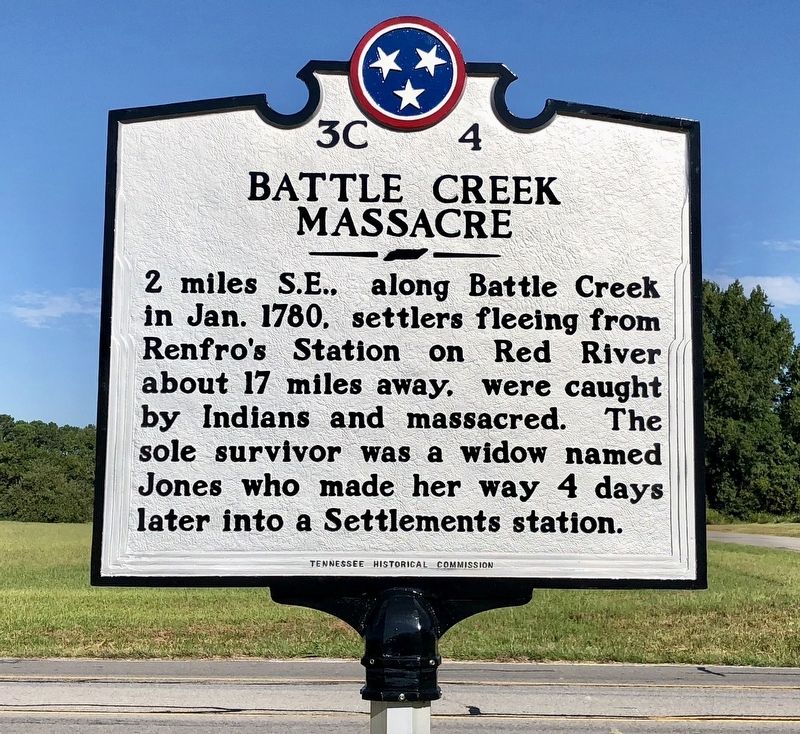

Predatory lenders explore some type of unjust, inaccurate, or fraudulent means during the mortgage origination

Abusive Credit Strategies and Property foreclosure Protection

Predatory credit is set by the FDIC once the act from “imposing unjust and you can abusive mortgage terms into the consumers” in addition to loans is disadvantageous so you’re able to individuals. Lenders incorporate competitive post, mobile, Tv and other kinds of advertising which have pledges off finance in order to get free from obligations, or a false interest mortgage price to your a home loan, prompt bucks through to the next salary will come in, or other types of luring into the ignorant or unsuspecting borrowers.

You can now be a victim regarding predatory lending. Loan providers encourage consumers in order to invest in mortgage words that make challenging to settle the mortgage otherwise defend against it when needed.

Daha Fazla Oku