Disclosure and you can Types of Identity Financing Charge

- Straight down Pricing: I charge % Apr (2.99 % monthly) towards the our Southern California name financing. Our costs are among the lowest away from old-fashioned loan providers so we continuously beat the competitors.

- Completely Amortized Money: For every commission Minimises your a great dominant harmony. There aren’t any prepayment penalties.

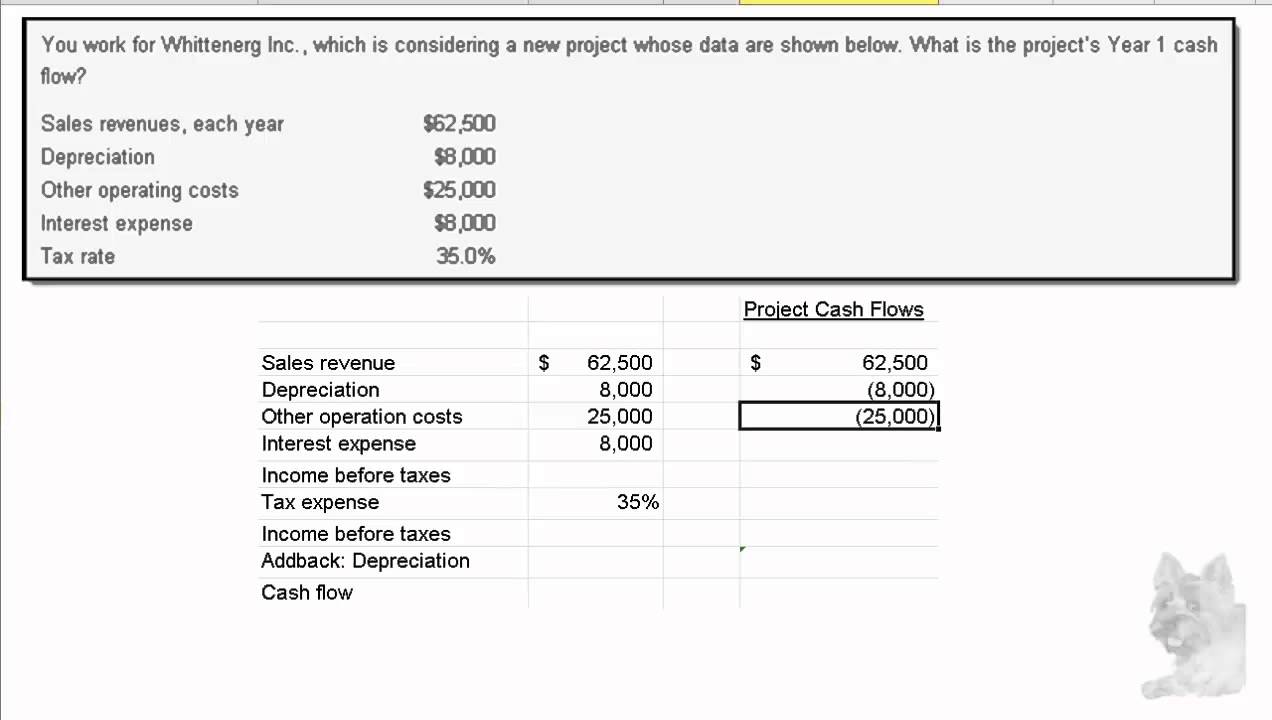

This new graph less than represents illustrative types of the cost of a great loan in order to a qualified debtor. For those who have any questions, otherwise would want more details, excite inquire. Make certain the questions you have is actually responded totally. Make certain you see the conditions and you may will set you back of the mortgage.

- There aren’t any charges in making more repayments or prepayment.

- Apr are computed predicated on all of the payment symptoms being off equal duration.

- A lot more charges: California lien fee off $ try funded. Prepaid service Paperwork Payment was $ for loans $dos,600 to $4,999 or 5% getting loans $5,000 or maybe more.

- Borrowers are considered certified with a credit score off 690 otherwise finest, dos including many years of a job and you will 3 along with years in the its current address.

- Vehicles Financing uses the fresh new FICO rating strategy whenever credit rating was a cause of determining consumer credit history.

- Minimal loan amount is actually $dos,.

There was situations where there is certainly a declare below this new Owner’s Plan not in Loan Policy, and you will charge versa

Copyright 2024 Funding Economic, Inc. | www.cashadvanceamerica.net/installment-loans-vt/ Most of the Liberties Kepted | Confidentiality | Funds produced otherwise setup pursuant to help you Ca Investment Legislation Permit 6038638

That loan Plan ensures the lender not only that you own the house or property, but also assures new legitimacy, consideration and you may enforceability of your own lien of their home loan, at the mercy of the brand new exceptions and you can exclusions lay out regarding the coverage

After you get a property with all cash out of very own pocket, and you also won’t need to acquire any money to simply help pay the price, the only identity plan attempt to buy was an Customer’s Policy, since you are the only person with an intention from the assets. But when you you would like that loan to simply help pay for the fresh assets, their financial will need one to indication home financing placing an effective lien on your property to keep the financing. The financial institution will also require you to buy a title plan guaranteeing its lien at your residence, hence name policy would-be that loan Policy. So, the simple way to the above mentioned real question is: You must buy a loan Rules because your financial needs that do it.

An user’s Rules provides you, because the purchaser and you can owner, which you individual the home, subject to the new conditions and exclusions set out on rules. The coverage looks like the same, but can end up being completely different.

New Customer’s Plan is awarded about quantity of the purchase price of the property, guarantees the owner which he features a beneficial title with the genuine estate, and can grab different into the purchase money mortgage (one of other exceptions) in Plan B of one’s coverage. That loan Policy are awarded throughout the quantity of the loan into the property, insures the financial institution your proprietor provides a beneficial label towards the home, and this this new lien of purchase-money home loan is actually an excellent valid and enforceable lien to your a house. Just like the one another title guidelines ensure the state of new identity, they contain overlapping coverage, and so there can be a good commonality off chance towards both policies. But not only were there other entities insured in guidelines, nevertheless welfare insured differ.

The borrowed funds Policy insures the financial institution and you will lender’s lien towards assets, and will not bring people security otherwise publicity towards manager. A typical example of the challenge in which there could be a state according to the Owner’s Policy just would be the circumstances where truth be told there was a conflict between adjacent landowners as to the area of the house boundary range. In the event your neighbor states the possessions range very lies 10 foot within your possessions, that the garage is truly into the his property in which he tries to end you against using your garage, that would be a prospective losings under your Owner’s Coverage out-of term insurance coverage, therefore the term organization manage protect the name once the insured. On the other hand, to make certain that the lender for a loss of profits within the Loan Rules, here must basic getting a default according to the terms of the mortgage you to impairs otherwise affects new validity, top priority otherwise enforceability of their lien. So long as there is absolutely no default within home loan, the lending company does not have any claim below their Mortgage Policy. Thus on the above claim example, as long as you continue using the mortgage repayments since the label organization is safeguarding your own label, there’s absolutely no losings for the bank as there is not any default, hence, the lender has no claim significantly less than their Financing Coverage.