It is unsure whether or not Veridian considers low-antique credit history to have deciding program qualifications or interest levels

Together with details about the individuals mortgage issues, Veridian’s website consists of many educational information that will help members understand the home loan application process and you can safe affordable prices, and posts, checklists, FAQ pages, and a video collection tailored to basic-day homeowners.

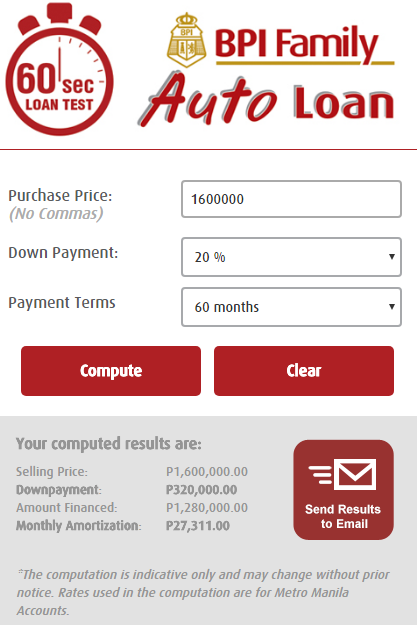

Your website and additionally it allows professionals to try to get pre-degree also to complete a mortgage app entirely on the web, without having to check out a part individually. Likewise, Veridian’s home and financial hand calculators allow simple to compare additional loan selection, however, participants dont found customized price prices and their webpages.

Veridian Grades

Veridian has generated a reputation due to the fact a part-centered borrowing from the bank commitment with well over 80 several years of feel serving the newest banking means out-of Iowa people. New monetary entity has been accredited due to the fact the same Housing Financial and its players are covered by the National Borrowing Connection Government for $250,000.

If you find yourself Veridian does hold an a+ rating from the Bbb, its Better business bureau character already features a single-celebrity customer get predicated on some recommendations.

Veridian Mortgage Qualifications

Mortgage brokers of Veridian are only accessible to homeowners with gotten formal credit commitment registration and every system provides novel eligibility recommendations. The financing union’s web site doesn’t render any information regarding median earnings otherwise debt-to-income criteria, nor will it specify if their home loan products have minimal borrowing from the bank score certification.

Centered on FICO, the quality credit rating stands around 740, that’s must hold the most readily useful available home loan rates. Extremely lenders will envision apps of borrowers that have fico scores since the lower since the 680, but direct confirmation off a financing representative is advised.

A lot of Veridian’s government-supported mortgage loans feature less limiting degree standards. Including, USDA financing can be found with little or no down payment and up so you can 100 percent capital, although property should be receive contained in this an eligible rural otherwise suburban area.

Veridian and additionally expands a number of sensible repaired-speed apps to possess very first-go out homeowners, allowing off costs only 3 per cent to have 15 and you can 30-season repayment words. At exactly the same time, closing costs will likely be taken care of having borrowed finance, a gift, a give, or other allowed supplies, though some program constraints incorporate.

Veridian Contact number & Most Info

- Website Url:

- Company Cell phone: 1-800-235-3228

- Headquarters Address: 233 Fisher Push, Waterloo, IA 50701

Completion

Veridian Credit Connection, having its sources within the 1934 and an affiliation that have Deere & Company, has changed since the a dependable user-centered organization inside the Iowa and you will parts of Nebraska. Prioritizing affordability and personalized service, they offer a diverse portfolio off mortgage facts. Whenever you are highly dedicated to associate studies and you can electronic the means to access, they uphold a localised means, mirrored inside their authoritative choices and representative-centric ethos.

A beneficial Financial Cents evaluates You.S. lenders that have a watch loan offerings, customer service, and you can full trustworthiness. We try to incorporate a balanced and you can in depth direction to possess prospective individuals. We prioritize editorial transparency in all our feedback.

Of the acquiring study right from loan providers and very carefully reviewing loan terms and conditions and you will criteria, i ensure an intensive comparison. All of our look, along with real-globe views, molds our very own analysis process. Lenders are then ranked toward individuals situations, culminating inside a superstar rating from just one so you’re able to four.Having a much deeper understanding of the requirements we use to price mortgage brokers and all of our testing means, delight refer to the article assistance and you may complete disclaimer.

Veridian Credit Partnership Remark

Unit Dysfunction: Veridian Borrowing Partnership, depending from inside the 1934, even offers a comprehensive list of financial characteristics mainly to help you Iowa and you will particular Nebraska customers. Dependent as a not-for-earnings facilities, Veridian generally focuses on providing several home loan activities customized to generally meet diverse financial demands.