Your own month-to-month mortgage report provides rewarding information regarding your home loan

Article Guidelines

Understanding how to see the month-to-month financial report will allow you to keep track of how fast you happen to be paying the loan, plus help you put one transform into the fee or the person you will likely be and work out your repayments to help you.

On this page

- What exactly is a mortgage statement?

- Just what a mortgage statement ends up

- Why should you see the home loan report

- Steps to make home financing commission

What is home financing declaration?

A home loan report try an accounting of all facts concerning your financial, including the current balance owed, attract charges, interest rate alter (for those who have a variable-speed mortgage) and you can a breakdown of your existing and you may earlier in the day repayments.

Lenders are legitimately needed to offer you home financing declaration for every billing cycle in the life of the loan. The fresh new file includes particular financing advice during the a standard style, which means you understand how per dollars of the mortgage repayment is invested.

Just what home financing declaration looks like

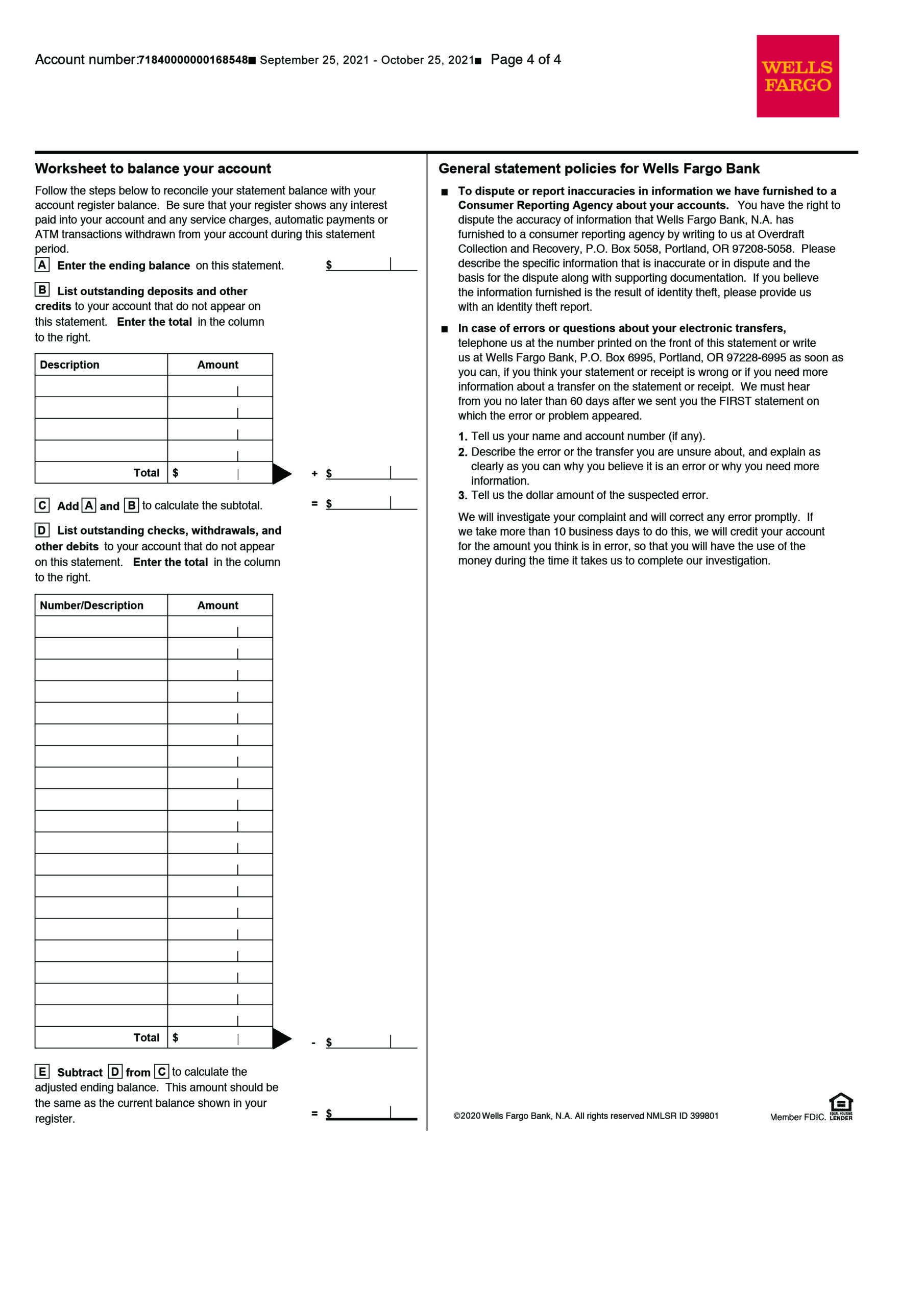

The consumer Financial Safeguards Bureau (CFPB) composed a sample document towards its webpages, which LendingTree adapted less than to explain each element of your mortgage report. Stick to the wide variety in the graphic below getting a paragraph-by-section report about what the report informs you.

step 1. Financial servicer information

Home financing servicer ‘s the providers one to collects your repayments and you may prepares the month-to-month comments. (Remember that it e team your closed the loan that have.) Brand new servicer’s contact information can be presented right here, so you can arrive at them with questions in regards to the declaration.

dos. Account count

Your bank account otherwise financing amount try linked with their identity and you may your house that is financed from the mortgage. You’ll want to feel the mortgage count handy when you’re contacting the loan servicer that have questions regarding your home loan.

Mortgage repayments are usually due towards the first of virtually any day, regardless if extremely servicers make you a sophistication age 2 weeks through the due date prior to you happen to be energized a late percentage. However, providing you make the payment contained in this 30 days out-of new due date, your credit report would not tell you new commission while the late.

Your mortgage repayment is actually commercially late if you don’t pay it by the firstly the new month. Your report should include a good when the paid back shortly after matter filled with a later part of the commission, that’s generally speaking charged if you make your commission adopting the 15th of your month.

5. Outstanding dominant amount

Here is the count you still are obligated to pay on the financial once making your payment. Per commission you create minimises your prominent, and you will make extra costs to pay off the mortgage before. Yet not, you may need to alert your own servicer in writing you need most fund used on your prominent harmony.

6. Readiness big date

Particular statements may include their maturity day, therefore you’ll know just how intimate otherwise much you are out of spending of all harmony. Just remember that , if you make most repayments, the fresh go out would be at some point since you’re paying down the https://paydayloansconnecticut.com/baltic/ mortgage quicker.

eight. Interest rate

Appeal ‘s the cost you shell out to borrow cash, and it’s according to the mortgage price you closed during the in advance of you finalized the loan. For those who glance at the amortization schedule you’ll have obtained along with your closing paperwork, possible notice that your primary commission would go to need for the first several years of your loan.

Be mindful of which area when you have a variable-rates financial (ARM), to discover if your rate changes. The loan servicer must send you observe regarding upcoming transform during the the very least two months before the payment deadline tied to the new first and further speed improvements. Experiencing this short article could help decide if it is for you personally to refinance off a supply to a predetermined-speed financing.