step 3.dos Payouts boosted of the highest rates, as banking field confronts uneven candidates

Ascending desire margins helped help the earnings of euro city finance companies within the 2022, especially in places that have large volumes away from changeable-price lending. The aggregate go back into collateral (ROE) regarding euro area extreme associations (SIs) rose by the step 1 payment section this past year to help you seven.6%. Conversely that have 2021, when a reduced amount of loan loss terms is actually area of the basis behind improving success, the advance for the 2022 try mainly passionate by highest key revenues (Graph step three.5, committee good). Interest margins surged on the back of your generous boost in policy rates beginning in summer time out of last year, if you are finance companies adjusted its put rates slowly. Margin expansion tended to getting higher when it comes to those regions that have good large share regarding loans supplied during the changeable rates, but additional factors in addition to played a job, such banks’ hedging actions together with rate of interest reputation additional the financial guide. On top of that, financing quantities made an optimistic sum to help you development in internet attention money (NII) in most places into the first 75% of a year ago (Chart 3.5, committee b, best graph). In contrast, NII flower quicker strongly into the nations particularly France where repaired-price financing predominates and you may banking institutions had currently improved put cost so you can a more impressive the amount. Internet percentage and you may commission money (NFCI) and additionally enhanced, even if on a slower price compared to 2021, if you are costs proceeded to go up (Graph step three.5, panel b, remaining graph). Earliest quarter 2023 income results for noted banks advise that even with down change income and higher will cost you, profits increased further on the rear out of higher NII.

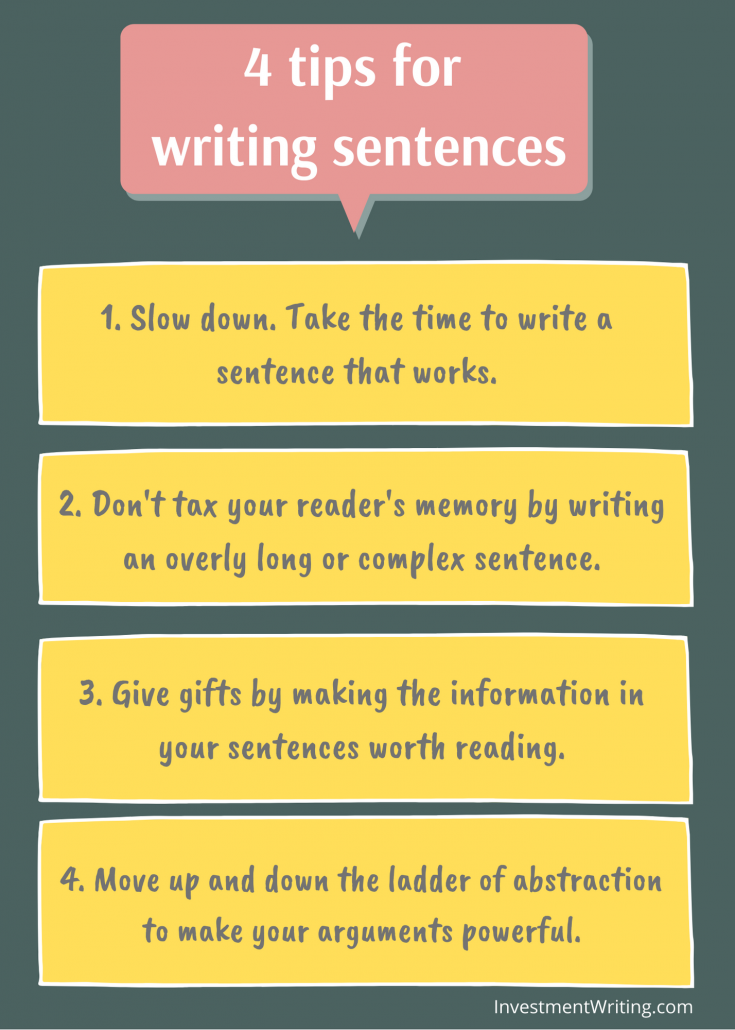

Chart step 3.5

Bank earnings enhanced after that inside the 2022 on the rear off stronger web attract earnings passionate by the higher margins, especially in places having adjustable interest levels

Sources: ECB and you can ECB data.Notes: predicated on a well-balanced shot of 83 euro city tall establishments. Panel b: the brand new display away from credit on changeable cost is based on the latest team amounts and you can identifies financing with an adjustable interest rate and mortgage obsession period of as much as 1 year. NII means online attract income; NFCI stands for net commission and you can percentage earnings.

Regardless of the banking business stress in the ics, industry analysts assume euro town bank profitability to boost further from inside the 2023. Market hopes of tomorrow aggregate ROE out of listed euro area banks to possess 2023 was in fact modified right up sizeably while the initiate of the 12 months, having ROE projections increasing out of 8.1% so you’re able to 9.2% between the end regarding this past year in addition to beginning of February (Graph step 3.6, panel an effective). The majority of this update is actually passionate by the high questioned NII from inside the an atmosphere in which rate of interest forecasts was in fact revised to remain large for longer, more offsetting the possibility impression off tighter borrowing from the bank criteria and you may delicate credit gains. Hopes of straight down impairments portray the second extremely important confident grounds, highlighting an improvement regarding the euro city macroeconomic outlook since the start of the this season. The latest compression in the banks’ field valuations when you look at the March and higher bank financial support costs didn’t apparently weigh to your bank success since the ROE standards increased further to help you ten.6% at the end of Will get. The additional up updates away from ROE traditional as March shall be charged mostly to higher NII, combined with keep costs down, high NFCI minimizing problems. Lender analysts may well change its ROE projections off going forward, given much more firmer financial credit standards, an effective slump during the loan demand and muted lending personality having NFCs specifically because of this (Graph 3.six, panel b).

Chart step 3.six

ROE projections getting 2023 was in fact modified upwards strongly in 2010, even after stronger credit conditions and you can slight development in financing in order to NFCs in particular