Past Corporate Credit: Examining Asset-Mainly based Loans having 2024

Daniel Pietrzak: To think about it generally, contemplate mortgage otherwise credit products that money the actual-industry cost savings. That isn’t old-fashioned corporate borrowing, not regular funds to businesses. I estimate that ABF is actually a good $5 trillion sector and you can broadening (Exhibit 1). With all of that, there has perhaps not come a great amount of scaled financing increased when you look at the the space.

Asset-Oriented Loans (ABF) has been grabbing the eye of several people that are looking for taking benefit of personal credit expenses, while also diversifying their profiles. This new advantage group try huge, coating many techniques from consumer financing in order to mortgage loans to tunes royalty contracts.

Daniel Pietrzak: Available they generally, consider loan otherwise credit products which money the genuine-business discount. That isn’t antique corporate credit, perhaps not regular financing so you can organizations. I guess you to definitely ABF is actually a great $5 trillion industry and expanding (Exhibit step 1). And with all that, there’s perhaps not already been numerous scaled investment increased into the the room.

We seated off recently having Daniel Pietrzak, Around the globe Lead from Private Credit, and you can Varun Khanna, Co-Direct from Advantage-Oriented Funds, to go over where in fact the opportunities are, where in fact the dangers are, and what they look for ahead for the next one year

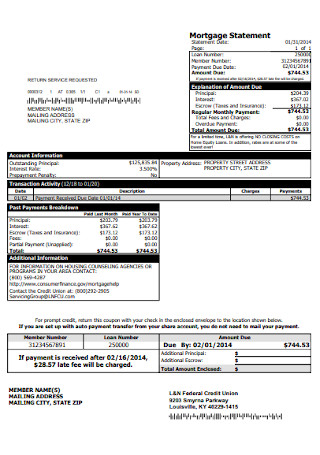

Signifies the non-public monetary possessions got its start and kept by the low-financial institutions centered in the world payday loan Linden, linked to household (together with mortgages) and you will organization credit. Excludes funds securitized or offered to help you regulators companies and you will possessions obtained in the resource avenues or through other supplementary/ syndicated streams.

I sat down has just with Daniel Pietrzak, Globally Direct out-of Personal Borrowing from the bank, and Varun Khanna, Co-Lead off Resource-Situated Financing, to discuss in which the possibilities is actually, the spot where the risks is, and you may what they look for to come for the next one year

Represents the personal economic assets originated and you can held because of the non-financial institutions founded internationally, regarding family (and additionally mortgages) and business borrowing from the bank. Excludes money securitized or marketed in order to authorities enterprises and you may possessions gotten from the capital avenues or through other secondary/ syndicated channels.

Consumer and you will mortgage money ‘s the premier part of the industry. Essentially, we are investing protected loan portfolios. They are secured from the a home in the case of mortgages otherwise automobiles regarding auto loan profiles, to name a few examples. We have and additionally focused on do-it-yourself fund or any other safeguarded profiles out-of money in order to best borrowers, instance leisure car (RV) fund.

Commercial funds comes with a number of credit you to definitely banks always carry out but i have pulled straight back on lately. Generally speaking, which involves finance to help you industrial consumers covered of the their essential property. Turn on Financial support, in which we help render investment to Irish homebuilders, was an example of one to. Because another example, we’ve produced financial investments backed by trading receivables to possess a giant tools brand.

Once we invest in hard assets, we really individual and you will control the underlying assets, and this we believe can offer a level of disadvantage safety. Those individuals possessions generally speaking build book earnings, basically over a somewhat long period of time. Aviation local rental or unmarried-household members leasing house was types of this.

Integer Advisers and you can KKR Borrowing from the bank browse estimates centered on current offered investigation at the time of , acquired out of country-certain specialized/change regulators as well as company account

Contractual bucks flows is more off the manage. For example, the songs royalty area are an area where we’ve been productive. We love so it part for the glamorous income reputation and also the diminished correlation on wide discount.

Varun Khanna: Investment positives and you can sector people was basically concerned with if indeed there would be a hard getting, the way the consumer commonly food, as well as how advantage cost tend to disperse, all of which enjoys a primary hit into resource results out of ABF. We’re a whole lot more selective and more traditional from inside the evaluating threats. Even though, I have already been amazed to get the audience is busier inside 2023 than ever before. The cause of that is the extreme dislocation in the fresh banking business together with societal financial support areas.