Choosing the right Roadway: Pre-Certification or Pre-Approval?

Starting the trail in order to pre-recognition delves to the a lot more detailed regions of your credit score, where comprehensive monitors you will briefly connect with your credit ratings. It’s an essential action one to grants loan providers an intensive snapshot of your debts. It’s important to match you which have an amount borrowed that corresponds accurately to what you really can afford.

Even when navigating so it detailed procedure you’ll temporarily delay your search getting homeownership, they reinforces new integrity of home loan application by building they through to very carefully vetted and you can confirmed monetary pointers, assure that one coming assets acquisition lies in solid financial products.

Benefits of Pre-Acceptance

With good pre-approval feels as though putting on good badge one shows the sincere focus and you will economic stamina. Regarding the competitive real estate market, where residential property was sought after secrets, pre-accepted directs a very clear message in order to providers which you remain once the a critical buyer who’ll fast and you may confidently seal the order.

Evaluating Pre-Certification and you will Pre-Acceptance

Pre-certification and you will pre-recognition may sound associated, but they serve different jobs in acquiring home financing. Pre-qualification feels as though an easy pirouette, easily mode things when you look at the activity. Pre-recognition takes cardio stage because the principal dance, requiring comprehensive vetting because of the lenders and you will exhibiting their even more profound height out-of relationship.

Each step of the process is actually high within monetary ballet. Gripping the line of characteristics assures a smooth results. Consider pre-qualification for your opening matter, and that gracefully leads to the fresh crescendo of getting licensed and you can being offered pre-accepted reputation-important goals on your own journey into protecting a mortgage.

Hence Process are Reduced?

Timely action is vital in the initial stages out-of shopping for property; and that, pre-certification emerges just like the quicker alternative. Its similar to getting a show instruct, swiftly moving you from their very first matter in order to gaining training contained in this around one hour.

Likewise, pre-recognition concerns a very thorough analysis process and certainly will end up being likened so you can delivering a lengthy-length excursion which can capture a few days otherwise months in order to complete-especially if your debts gift ideas outlined facts.

Amounts of Union regarding Lenders

Regarding a residential property domain, lenders highlight anyone who has reached pre-approval more than individuals who are merely pre-licensed. Pre-recognized applicants is actually seen that have higher respect and thought to be far more credible and significant managers of their cash.

When deciding anywhere between pre-certification and pre-acceptance in family-to order techniques, you have to consider a person’s standing. Are you currently just embarking on your home check, or will you be primed in order to plant your banner on a selected property? Both process let determine how much household a purchaser are able to afford, getting a clearer image of affordability.

Pre-certification will act as a first beacon in your mining stage, permitting contour this new trajectory of your see. On the flip side, pre-acceptance try comparable to equipping oneself to have battle on the strong realm of putting in a bid conflicts. They signals unequivocal intent and you may preparednessprehending exactly how being pre-licensed versus. delivering pre-approval differs from merely is alert by way of a short certification can be getting critical for effectively navigating with the homeownership victory.

Ideal for First-Day Homeowners

Acquiring pre-qualification is sometimes told as the a leading light for beginners exactly who purchase property. It offers newbies with understanding of the monetary standing and you may molds the category because of their domestic-query journey.

Perfect for Serious Customers within the Aggressive Areas

To possess knowledgeable homebuyers aiming for the dream assets, obtaining pre-recognition stands for he’s the full https://paydayloancolorado.net/stonegate/ time people. They serves as defensive hardware into the aggressive areas, where moving closer to home ownership needs strategic maneuvers.

Suggestions to Alter your Probability of Pre-Qualification and you may Pre-Acceptance

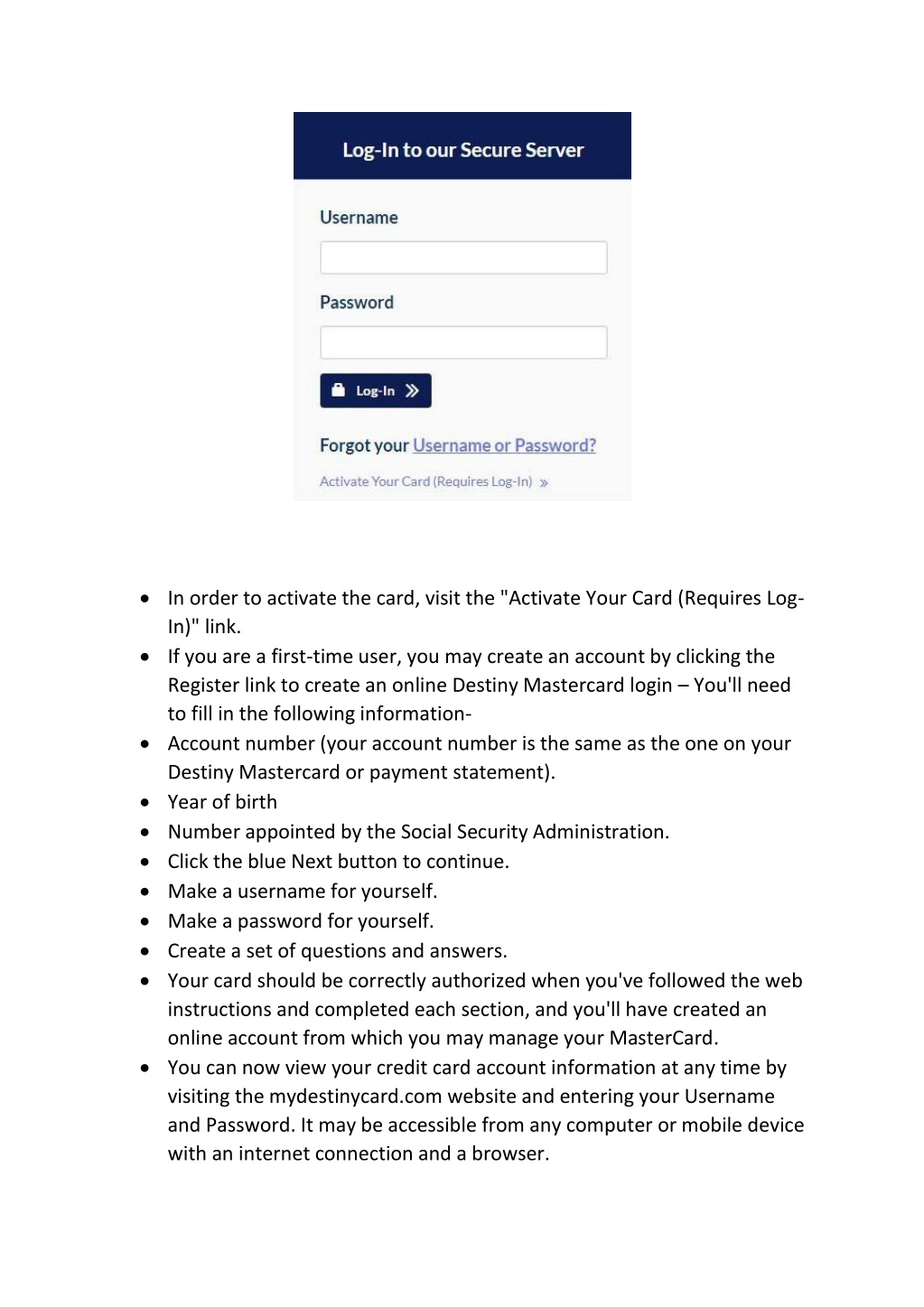

When starting the way so you can mortgage prequalification otherwise getting preapproval, it is imperative to make use of routes you to change your journey. Asking a realtor is somewhat boost your probability of pre-certification and pre-approval by providing a beneficial preapproval letter to exhibit proof financing. Possessing an effective credit score will act as a strengthening snap, powering your on the useful tourist attractions. Aware track of the brand new dynamic mortgage or credit card business fingers you which have training necessary for overtaking advanced propositions in case the monetary items change.