Research rates for no PMI Money you to definitely Reduce your Homes Costs Month-to-month

If you do not must lay as frequently money off, you can use one to tens of thousands of extra cash to pay for home improvements. This is exactly one of the many causes folks are raving throughout the zero PMI home loan financing.

Note that money which you pay money for home loan notice will be written off yearly, you usually do not do this with PMI costs. Which means you would like to stop paying PMI when you can. To own obvious factors, it offers end up being a hugely popular no PMI home loan program in the 2017. Then let the loan providers pay the financial insurance rates?

Piggyback Capital with no Mortgage Insurance rates

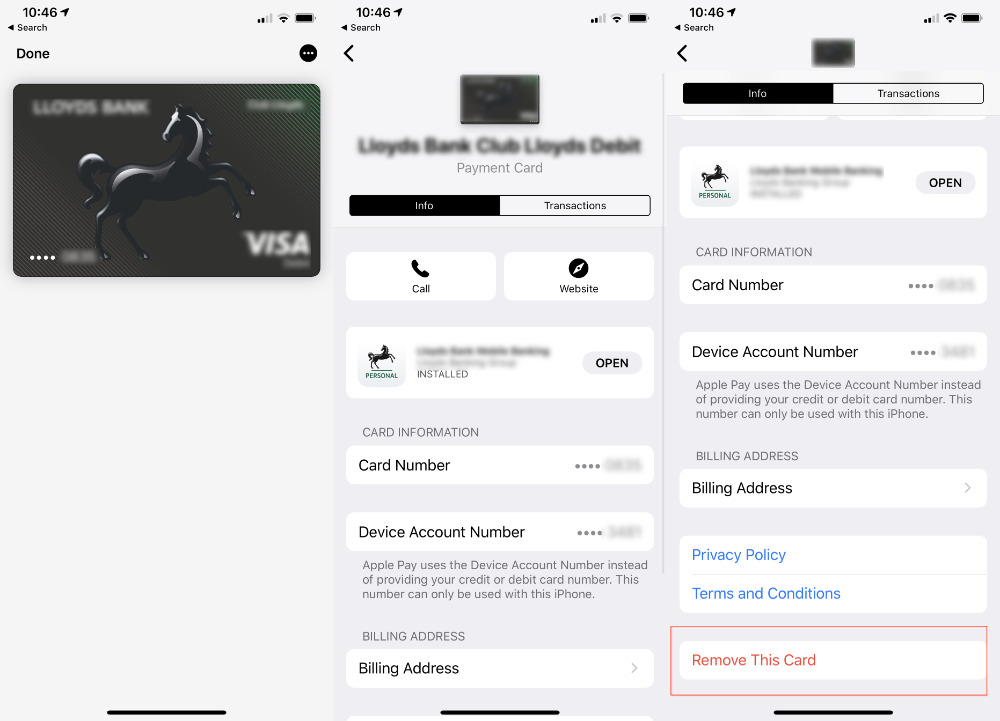

A well-known means of avoiding PMI will be to provide about a beneficial 10% down payment. In place of getting one ninety% financial, you may get two mortgage loans that happen to be piggybacked on to you to definitely a unique. A familiar contract should be to enjoys an enthusiastic 80% first-mortgage and a ten% next mortgage, followed closely by good 10% advance payment.

Daha Fazla Oku