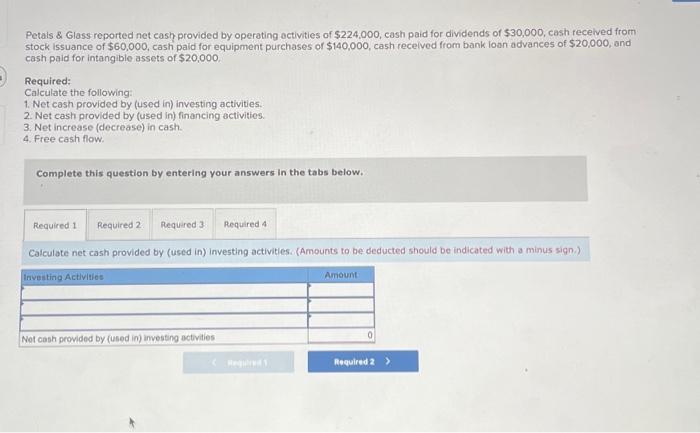

The required steps to get into an investment property HELOC

A debtor requesting a residential property HELOC by the a loan provider requires to get their monetary ducks consecutively. Because of the threats with it, loan providers is definitely mindful in relation to accommodations assets collection of borrowing from the bank. There is a lot on the line regarding good lender’s perspective, so expect to get ready in all implies you are able to. For just one, a debtor should have expert fico scores, big bucks supplies, while having possessed new investment property for at least one year.

The lending company will most likely need proof of good clients that produce timely and you can uniform book repayments, and you will evidence of a lease agreement. Not only will the current investment property circumstance become cautiously examined, however the borrower’s entire record since a genuine estate individual have a tendency to getting scrutinized in advance of a loan provider grants a rental assets distinct borrowing from the bank.

Daha Fazla Oku