All the way down Monthly payments: The newest Attractiveness of Mortgage refinancing

One of the primary explanations homeowners thought refinancing their home loan is actually when deciding to take advantage of straight down interest levels. Interest levels normally change through the years, of course your took out your home loan whenever prices was large, refinancing at the a lower price can somewhat decrease your monthly installments. This may potentially save thousands of dollars across the lives of the mortgage.

Refinancing your own home loan may end up in lower monthly premiums. By the protecting a new mortgage with less interest or extending the fresh new installment label, you can probably lessen the count you have to pay every month. This may provide extra money disperse on your finances, allowing you to allocate that money on almost every other financial goals or expenditures.

Opening Their House’s Security: Unlocking Financial Options

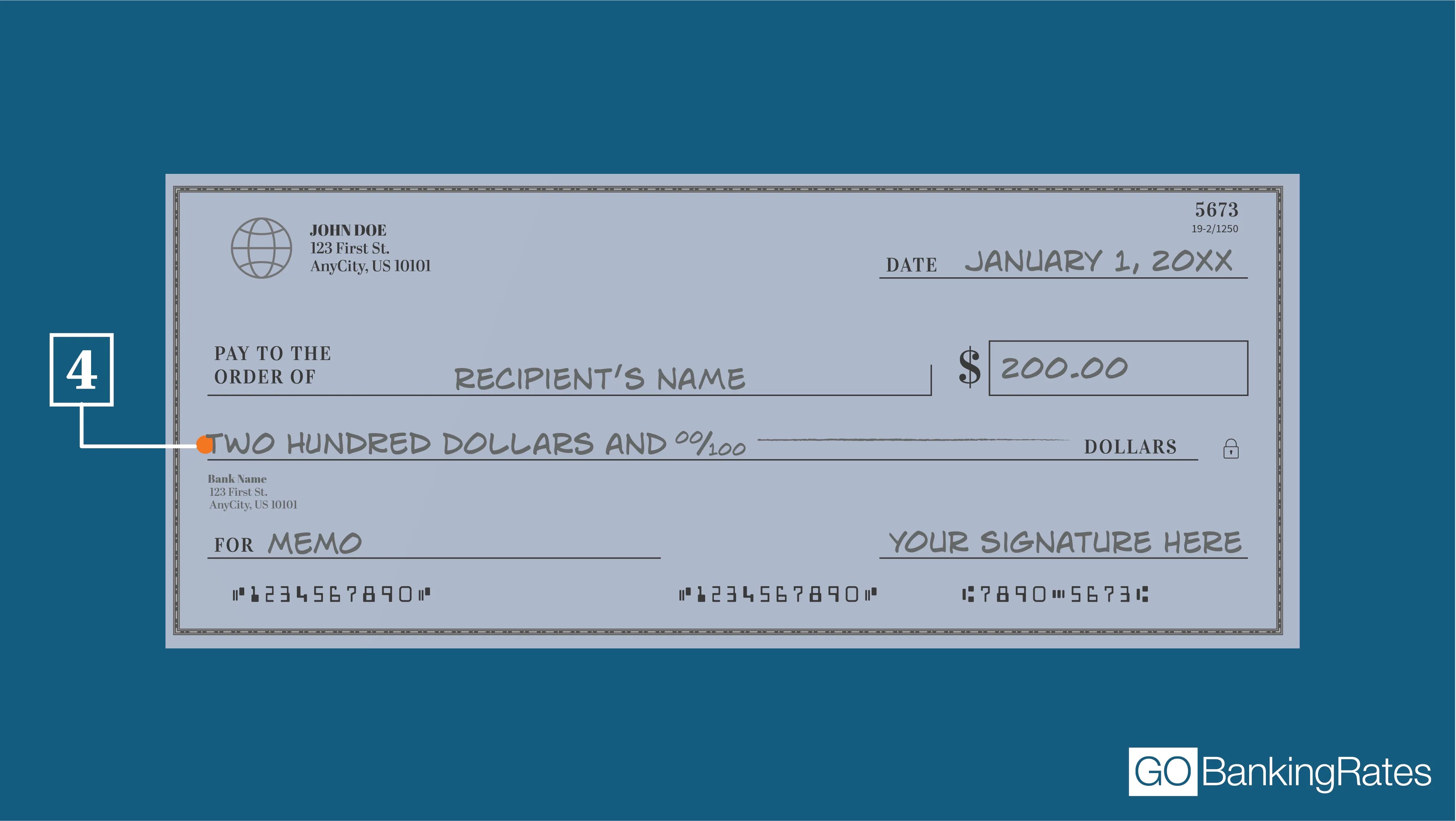

If you’ve built up equity of your house, refinancing your financial can provide a chance to availableness you to security. Courtesy an earnings-out refinance , you might borrow against the fresh collateral you have built-up and found a good lump sum payment of money. This can be good for certain intentions, instance renovations, debt consolidation reduction, or financial support educational costs. You should check out the potential much time-term economic ramifications off accessing their house’s guarantee prior to proceeding that have that one.

Combining Financial obligation: Streamlining Your money

A separate prospective benefit of refinancing the home loan ‘s the possible opportunity to combine financial obligation.

Daha Fazla Oku