FHA is amongst the most significant government mortgage programs aside here

One of the most prominent getting a home to own first-date consumers now are government recognized programs. When you are an initial-go out homebuyer, this method features interest. Earliest, you could only need step 3.5% down to buy the domestic.

The rate towards the FHA money is practical and you may comparable with antique cost

With such as for instance the lowest-downpayment will be a massive help due to the fact of several basic-time people lack equity collected otherwise loved ones who can assist which have a downpayment.

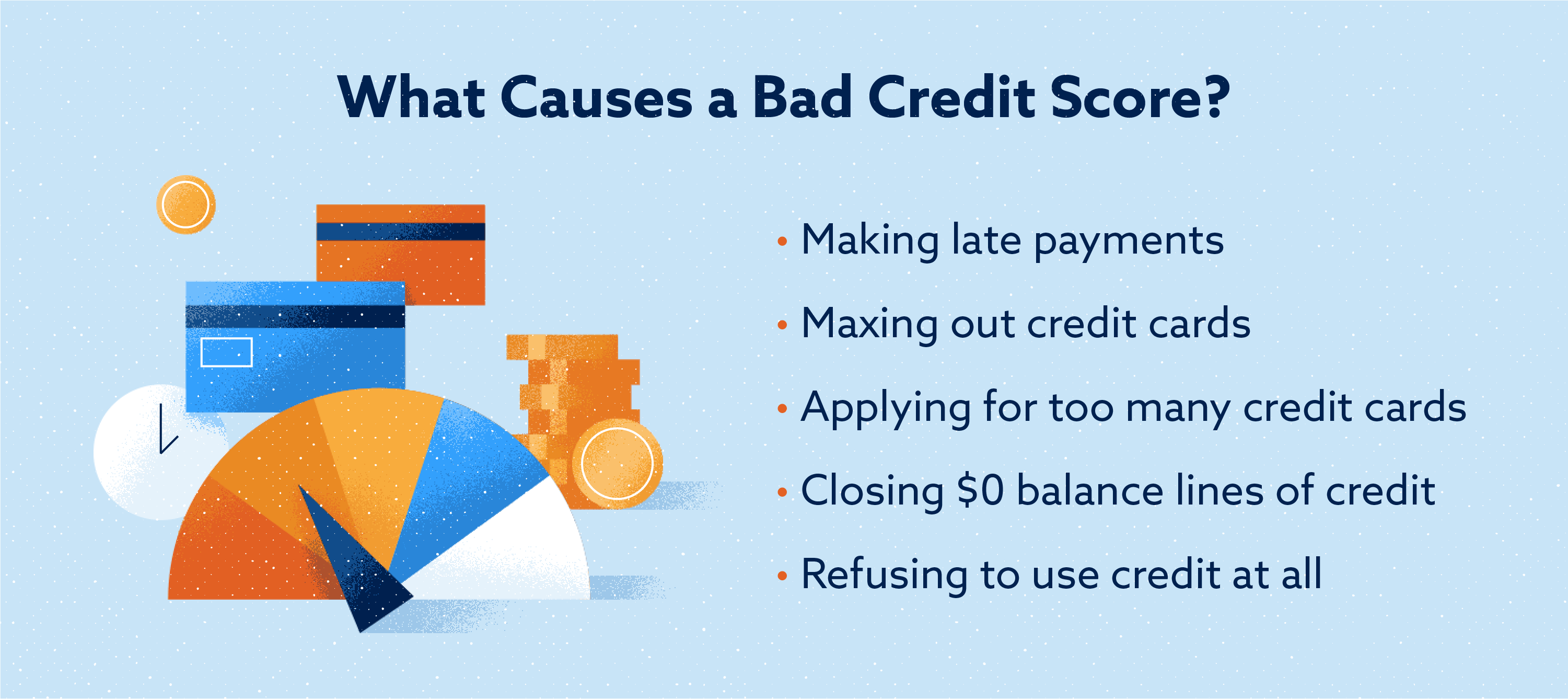

FHA apps supply practical borrowing requirements; of many can be be eligible for a keen FHA loan with just a 580-credit rating. It’s simpler to get financing that have an effective 620 score however, research rates and you can see a lender who’ll help.

An alternative fantastic option is USDA loans, which happen to be designed for lower income People in america when you look at the rural section

These types of funds provide low interest rates and many with straight down borrowing scores normally meet the requirements.

Daha Fazla Oku