Renovation Financing Against. Consumer loan: That is Right for Your project?

Getting into a property renovation investment try a captivating attempts you to definitely enables you to change the room into the new things and you can refreshing. However, one of the crucial aspects of one recovery enterprise is actually resource. Regarding financing your house restoration, you really have several options offered, with renovation funds and private finance getting one or two common choices. Inside blog post, we’ll explore the distinctions between restoration finance and personal loans, showing its secret has and you will helping you decide which choice is suitable fit for assembling your shed.

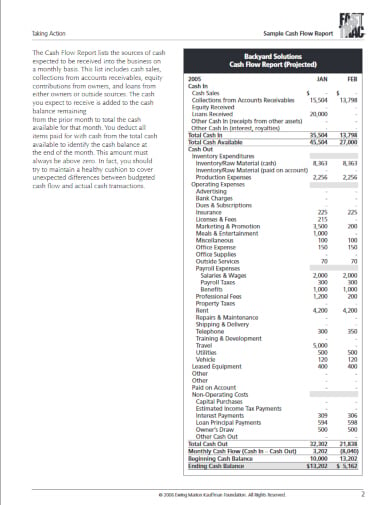

Repair Fund:

Restoration financing, known as do it yourself financing otherwise household restoration financing, are specially made to fund do-it-yourself projects. These types of finance is actually covered by your possessions and you can typically require some sorts of guarantee, such as your house’s equity and/or renovated assets itself.

Daha Fazla Oku