As to the reasons property guarantee loan is better than these 5 solutions

Rising prices stayed stubbornly packed with January, perhaps driving straight back one interest slices from the Federal Put aside. However, the newest long line chart means an air conditioning development, albeit a rough that. However, lenders have already begun lowering mortgage costs for the expectation of every cuts to your government finance speed. Centered on Freddie Mac computer, the rate into a traditional 29-12 months repaired-rate mortgage is currently 6.90%, down out of 7.79% inside late Oct.

Fortunately to have residents is that even after dips in some portion, prices are fundamentally holding constant and you can sustaining home collateral to possess residents. A 2023 report in the home statistics corporation CoreLogic claims an average citizen regarding You.S. retains $300,000 in home collateral.

That have straight down rates than other types of lending, home collateral financing may be a good option to own borrowers. An informed lending alternative hinges on a number of activities, such as the amount borrowed, borrowing will cost you and your big date opinions to own installment. Yet not, a house collateral financing could well be a far greater option compared to the less than five possibilities into the specific products.

Credit cards

As of March 27, an average house security loan interest is 8.78%. That is substantially less than an average charge card interest from %, depending on the Government Set-aside. If you are searching so you’re able to use a hefty amount, particularly $50,000 to own property recovery venture, you could save several thousand dollars inside the interest charges across the life of the mortgage.

“When you need a big sum and certainly will pay it off more a longer time, a home collateral financing is best choices,” says Mike Roberts, co-creator out of Urban area Creek Financial. “The eye rates on the domestic equity fund are generally down, which makes them significantly more cost-productive.”

Remember, household equity finance make use of domestic while the security, which means the bank you will foreclose in your house for individuals who default on financing. If you want a lesser amount of, a charge card or any other alternative ount quickly.

Unsecured loans

Just as in credit cards, household collateral financing are more straightforward to signature loans because they usually incorporate all the way down interest rates. They also have high borrowing limits, as much as 75% to 85% of your own house’s equity. As stated, U.S. homeowners features normally $three hundred,000 when you look at the guarantee, which means that they could probably use from $225,000 so you’re able to $255,000. In comparison, borrowing number into signature loans usually cannot exceed $100,000 . While consolidating a large amount of loans otherwise starting a good costly home improvement endeavor, the higher credit limit minimizing rates can be advantageous.

Costs Westrom, this new President and maker from TruthInEquity, advises individuals avoid borrowing the maximum amount, regardless of if it meet the requirements. “When we have fun with 2008 so you’re able to 2009 as the a coaching concept whenever home values slide, you may find oneself when you look at the an awful security condition that might bring years to recover from.”

Cash-aside refinance finance

If you took your most recent home loan in advance of 2022, your have in all probability an even more positive speed than you can find in the market now. Especially, mortgage loans taken out between 2019 and 2021 have average rates of interest lower than cuatro.00%. Refinancing during the the current large pricing does not build far experience. Property collateral financing makes you availableness the amount of money your you prefer instead altering the fresh terms of your modern financial.

“If you have an initial home loan with an intention rates from 4.00% or faster, never give it time to break free,” states Westrom. “There actually is no free of charge conflict with the bucks-aside refinance for those who have the lowest, low rate currently.”

Domestic security personal lines of credit (HELOCs)

While you are household collateral lines of credit (HELOCs) is a number of the exact same advantages as household collateral fund, there are times when aforementioned can be more beneficial. For example, home collateral money can present you with a huge amount of currency upfront, whereas HELOCs are created to draw finance as required over the years.

While doing so, domestic equity loans feature repaired interest levels, while you are HELOCs typically have changeable of these . With a stable price and payment one remains the exact same through the the loan, a property guarantee mortgage is much more predictable and simple to deal with. In addition it can save you to the desire costs whilst isn’t really susceptible to rate of interest activity.

401(k) money

Each other a great 401(k) loan and a home collateral loan allow you to “obtain away from yourself.” A beneficial 401(k) mortgage makes you obtain doing $50,000 inside the crisis dollars out of your retirement package, and spend yourself straight back within this five years that have focus, usually a point otherwise a where can i get an itin loan in Sugarloaf couple of greater than the modern best rates.

Although not, borrowing from the 401(k) appear on a large options cost. The cash your withdraw will no longer secure interest, therefore could take age in order to regain your own previous account updates. During the those individuals 5 years out-of fees, you might forfeit their employer’s coordinating benefits, in addition to all the way down balance often give smaller earnings.

Which have a property guarantee financing, you can shell out desire fees, plus the exposure to your residence have to be highly felt. not, a well-prepared family collateral loan that have affordable repayments would be noticed a a whole lot more favorable solution than just burning up pension savings.

The bottom line

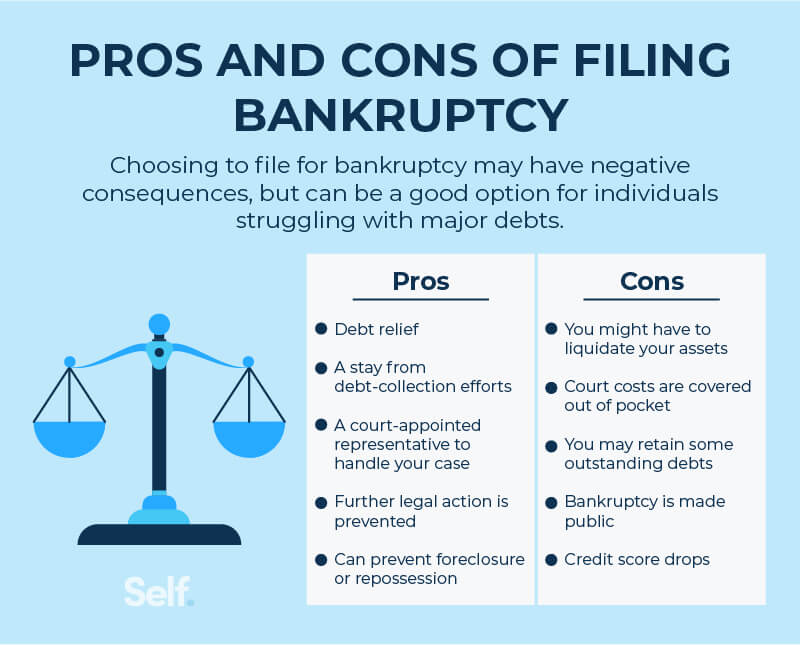

A property guarantee loan can be more useful compared to options above in lot of things, not always. Choosing whether or not to get property collateral financing, one of those five alternatives or any other funding alternative will be for how for each option address your unique things. Speak about your options and study the latest fine print prior to continuing which have people loan also provides. Eventually, make sure to is also conveniently spend the money for costs on the one the brand new financing otherwise credit you’re considering before taking with the this new debt.