Address will bring contracted out loan management attributes to help you banking institutions and you will strengthening societies, and additionally Shawbrook Financial

After almost half dozen many years of courtroom objections, the latest Finest Courtroom has made a last decision regarding Target Class Ltd.is the reason (Target) updates you to their loan government functions to a bank constituted an excellent VAT-exempt source of loans attributes. New Best Judge keeps ruled which they dont. So it decision overturns prior caselaw and may possess a knock-with the impression for almost all supplies created by certain financial intermediary organizations in addition to creditors by themselves while the customers.

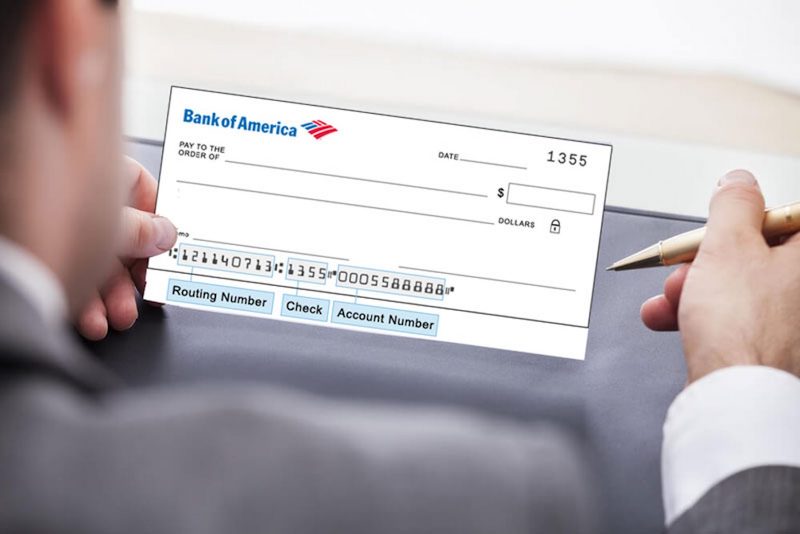

The basics

- The situation, import, receipt or making reference to currency

- Mortgage management characteristics by person giving the loan

- This new process off a current, put otherwise checking account

The brand new objections

Shawbrook are a merchant of various mortgages and you can financing. Given that Address wasn’t the lending company, this may maybe not believe in the new exception significantly less than b) significantly more than.

Target failed to render one mortgage origination properties so you can Shawbrook one usually are thought to be VAT exempt – eg interested in potential individuals, vetting loan applications, carrying out valuation monitors, settling terms of credit, and you will organizing new performance of mortgage.

In the Earliest Level Tribunal reading ahead, Target’s earliest argument are that loan management features wanted to Shawbrook eligible to exception to this rule because a financial services because it:

- Composed a loan levels, shortly after mortgage have been made

- Manage the account and you will transactions towards customers around the fresh new point out-of last installment

- Paired money so you’re able to individual loan account and understood destroyed repayments

- Generated the new information to possess lead debit money (a great BACS file out of digital fee rules in order to banking companies working the fresh borrowers’ bank account)

- Calculated the latest levels of appeal and dominating repayments owed, and also for calculating and using any charges

- Looked after people overpayments, missed payments and you will arrears

HMRC contended you to Target’s provides had been substance nonexempt supplies out-of treating financing accounts’. Rather, HMRC thought Address was delivering nonexempt debt collection’ attributes.

Brand new Court judgments

Within first phase associated with the argument, the original Level Tribunal overlooked Target’s desire, holding that mortgage administration qualities was indeed business collection agencies attributes and you will ergo weren’t exempt. Address appealed against this decision to your Upper Tribunal.

The top of Tribunal ental top, the new difference could not affect the services Address offered. The newest judge told you simply providing BACs guidelines or creating and you will maintaining Shawbrook’s finance membership did not make up an exempt financial purchase. For this reason, it was not important for top of the Tribunal to take on the new debt collection conflict; the top of Tribunal located facing Address.

The fresh new Courtroom away from Interest took a comparable range whenever rejecting a beneficial further notice from the Target and ruled the features provided by Target so you’re able to Shawbrook just weren’t ‘transactions concerning repayments or transfers’ even after indeed there becoming specific precedent British caselaw (FDR Limited -Court from Interest 2000 STC 672) for taking a wider way of using the exception inside the times where intermediaries have been mixed up in purchase.

The new Best Judge echoed this reasoning and you may specifically stated that a great far narrower method to the usage new exception should incorporate since the established in this new Judge regarding Fairness away from European union (CJEU) governing from inside the DPAS (Situation C-5/17), certainly a great amount of CJEU rulings in this region promoting a good narrow’ means.

The new Ultimate Judge try clear from inside the saying that it was overturning the earlier FDR wisdom – they reported that the newest exception to this rule will be merely use where the supplier is:

“. mixed up in performing otherwise execution of your import or payment its “materialisation”. This requires useful contribution and gratification. Causation [ie offering BACS directions] was lack of, yet not inescapable the results.

The basic question arising getting Target is that they had been administering funds which had already been made before its involvement. Getting off brand new wider’ strategy adopted from the Legal out of Notice in the FDR, it felt like one Target’s offers had been nonexempt.

Our feedback

Since the direction of the latest situation-laws have moved on the thin interpretation of your different, the results regarding the decision isnt a surprise. Yet not, this choice does not address the latest broad concerns on the VAT answer to organizations with alternative formations in position to help you provider lenders according of financing management.

Whilst the there is certainly much more clarity to your boundaries of difference, it will improve the case of brand new the quantity that which increase inefficiencies and costs within the a provision chain related to excused monetary features in the united kingdom.

It is expected one to HMRC usually today publish an official Short-term which have recommendations on simple tips to pertain the newest exclusion within the a selection away from problems additional reading. This may involve clarifying if they are intending to simply take people retrospective step for enterprises depending on this new wide translation of your difference (making use of the FDR beliefs).>/p>

Ramifications for financial features people

Inspite of the clarity that Best Judge ruling brings, this stays an intricate area of VAT so delight get in touch with Aditi Hyett otherwise Stephen Kehoe for suggestions about your specific arrangements.