Qualifying Having Vegas Mortgages After Bankruptcy and/otherwise A property Skills

That have a past bankruptcy proceeding, property foreclosure, deed as opposed to foreclosures, otherwise short sale does not truly apply to financial cost. However, borrowers will be make an effort to improve their credit ratings before you apply to own a mortgage. This is exactly especially important when purchasing property with poor credit during the Las vegas, nevada, since the highest credit ratings basically produce lower home loan pricing. Multiple successful processes can be found to rapidly boost your credit rating in advance of entry home financing app. Follow this link so you can qualify for Las vegas mortgage immediately following bankcruptcy

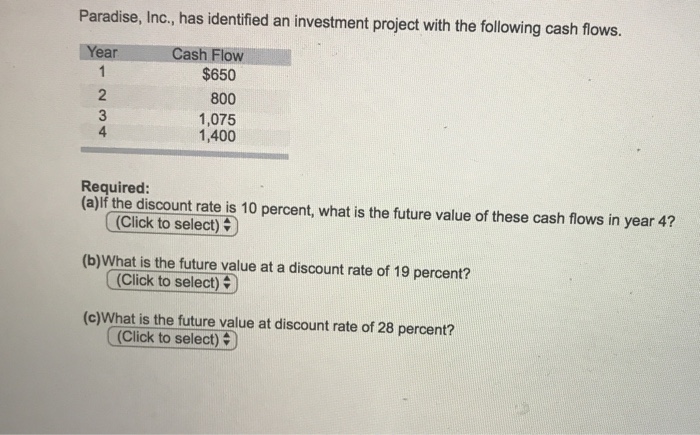

Minimum Agency Financial Advice into the Credit ratings In order to Qualify for A Real estate loan

When purchasing a house having less than perfect credit when you look at the Las vegas, it is critical to remember that all the mortgages possess minimum credit get criteria centered from the FHA, Virtual assistant, USDA, Fannie mae, and you can Freddie Mac. A reduced credit score might still will let you be eligible for a mortgage for people who meet with the minimum department guidance. But not, cannot have experienced any late costs in the last 12 months to receive acceptance from the automatic underwriting system.

Mortgage loan Standards For buying a property That have Bad credit during the Las vegas

- HUD, the fresh mother regarding FHA, demands a good 580 credit score to be eligible for a great step 3.5% down-payment home get FHA financing

- Homeowners with below 580 fico scores and you may down seriously to a 400 FICO normally qualify for an enthusiastic FHA financing with a good 10% deposit

- Fannie mae and Freddie Mac need no less than an effective 620 credit score into the conventional fund

- Virtual assistant loans don’t possess a minimum credit history requirements due to the fact long because the debtor will get a keen approve/eligible per the fresh new automatic underwriting program (AUS)

Increasing Fico scores To help you Be eligible for a home loan In Las vegas

Despite no matter what minimum credit rating needs is actually, borrowers need to optimize their fico scores in advance of implementing getting a home loan. The better the credit results, the lower the loan prices. Repaying the bank card stability to help you lower than a good ten% borrowing from the bank utilization americash loans Tarrant proportion will optimize consumer credit score. Quick costs in earlier times 12 months is a necessity to get an automatic underwriting program approval. Va and FHA money enable it to be instructions underwriting. Manual underwriting advice need a couple of years out of punctual payments into all the bills.

Qualifying For buying a house Which have Less than perfect credit when you look at the Las vegas, nevada that have a loan provider And no Overlays

Individuals who are in need of so you’re able to be eligible for a home loan having crappy borrowing that have a five-superstar national mortgage lender signed up inside numerous states and no financial overlays, excite contact us during the 800-900-8569 otherwise text united states to possess a faster effect. Or current email address you within group at the Gustan Cho Associates are offered seven days a week, nights, vacations, and you can holidays.

To acquire Property Having Poor credit inside the Las vegas, nevada With All the way down Credit Results

We will discuss to invest in a home that have less than perfect credit within the Oklahoma in this post. Purchasing a house with less than perfect credit during the Oklahoma is achievable. Lenders remember that tough-functioning someone may have episodes from less than perfect credit due to loss out of jobs, loss of business or other extenuating activities like members of the family things, issues, and separation and divorce. While you are later on your own month-to-month loans repayments, financial institutions will declaration them to the credit reporting companies.

The importance of Timely Money in earlier times one year Whenever Qualifying To have a mortgage

Brand new derogatory pointers stays on your credit history to possess a time off 7 years regarding the big date of one’s past hobby. With bad credit feels as though that have an effective hangover. Thoughts is broken thirty day period or higher late on your monthly debt money, it can plummet the credit ratings. But not, while the derogatory credit recommendations ages, the credit scores often gradually get back right up. Eventually, poor credit can get little or no affect credit score. Yet not, it takes returning to credit scores locate support. There are ways of expediting boosting credit ratings support. In the following paragraphs, we’ll speak about to get a home with bad credit during the Vegas.