Eligibility Criteria having a great Sierra Pacific Mortgage

Once you have discover your ideal household, you can over a complete financial software. Sierra Pacific will then verify debt information, in addition to lender statements, taxation statements, and you may work history.

3. Underwriting

Through the underwriting, Sierra Pacific commonly measure the risk of lending to you personally. This action comes with a-deep diving to your money to make certain you can manage the loan money.

cuatro. Closure

If the most of the happens well inside underwriting, you can move on to the fresh new closure procedure, in which it is possible to sign the last files and you may theoretically safer the loan. At this point, the loan financing are distributed, and you also obtain the secrets to your domestic!

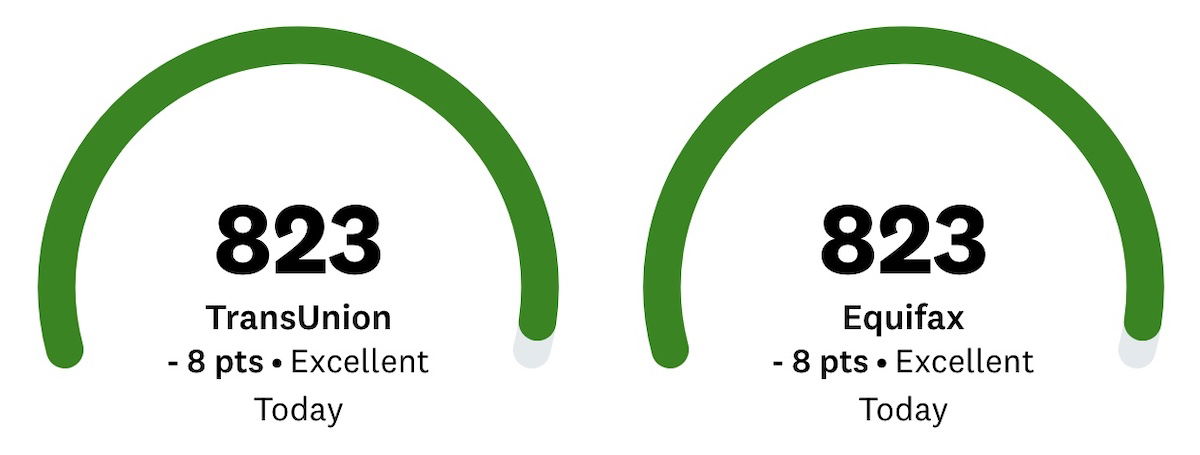

- Credit score: If you are certain requirements will vary, old-fashioned fund have a tendency to require a credit history of at least 620.

- Income Verification: Lenders have a tendency to ensure your income to make certain you can make monthly home loan repayments.

- Down-payment: With respect to the style of mortgage, your downpayment can get start around step three% to help you 20% of one’s house’s price.

Wisdom Rates of interest and you may Loan Terms and conditions

When selecting a mortgage, you’ll need to determine ranging from fixed and you may variable interest rates. Fixed rates are nevertheless a similar regarding life of the loan, giving balances. Changeable pricing, concurrently, is fluctuate centered on business requirements, which may bring about lower repayments initially but could boost after.

What to expect Immediately following Pre-Approval

Once you have already been pre-approved, it is the right time to collect and you may fill out very important records. You’ll need to bring pay stubs, taxation statements, lender statements, or other types of monetary confirmation. Following arrives the latest underwriting techniques, where your loan application is examined in detail.

Closure the borrowed funds which have Sierra Pacific

The latest closure procedure will be guts-wracking, but Eagle installment loan no credit checks no bank account Sierra Pacific walks you compliment of they each step of one’s way. Towards the closure big date, you are able to sign the requisite files and you can spend one leftover charges or down payments. After that is over, the loan was signed, and technically name oneself a resident!

Benefits associated with Refinancing which have Sierra Pacific Financial

For individuals who currently very own a property, refinancing that have Sierra Pacific will save you money by the securing a lowered interest rate, consolidating personal debt, otherwise taking out guarantee to other economic demands. Cash-away refinancing enables you to tap into the residence’s value having such things as renovations otherwise paying down high-notice loans.

First-Day Homebuyer Apps

For first-date consumers, Sierra Pacific has the benefit of special software that come with down payment guidelines, smoother borrowing from the bank requirements, and versatile financing choice. These types of applications are made to make homeownership available to those who may not qualify for antique financing.

Customers Critiques and you will Stories

Precisely what do actual users must say? Sierra Pacific Home loan consistently obtains large marks for the customer service, aggressive pricing, and you may smooth loan procedure. Of a lot consumers take pleasure in this new obvious telecommunications and you can service they located while in the their property-to invest in travel.

Just how to Take control of your Home loan On line

As soon as your financing try closed, dealing with it’s easy. Sierra Pacific’s on line site enables you to build repayments, tune the loan equilibrium, to see statements. Access the loan details anytime guarantees you stay on greatest regarding payments and give a wide berth to later fees.

Conclusion

Sierra Pacific Home loan offers a great deal of alternatives for homebuyers, whether you are only starting out otherwise trying to re-finance an existing loan. That have competitive prices, an array of loan points, and you will exceptional customer service, Sierra Pacific is actually a dependable lover on your own homeownership travel. Willing to get started? Touch base now and commence the road to buying your perfect household.

Faqs

The borrowed funds process usually takes between 31 to help you forty five days, based your debts and how rapidly you might bring the mandatory data files