Aggressive Origination Charges getting Federal Shield Virtual assistant Financing

The fresh Virtual assistant home loan system now offers experts, effective services participants, and you can thriving partners with many helpful professionals that will help rescue them thousands of dollars in conclusion can cost you and you may on lifetime of its financing. Just what particular National Guard players may well not know is because they are entitled to found such pros given from Va mortgage program when they fulfill certain service standards.

While you are a national Guard representative seeking talk about their Va mortgage options, telephone call HomePromise during the 800-720-0250! All of our home loan gurus tend to tune in to your specific factors, respond to any queries you have about the lending techniques, and provide you with a totally free interest price. Va fund having National Protect participants is going to be tricky so offer all of us a visit today getting help.

Military National Shield Va Financing Qualification

In the HomePromise, our very own home loan positives usually are asked in the event the National Guard players are and additionally qualified to receive Virtual assistant funds. The answer are yes, as long as this new National Shield associate matches being qualified financing requirements and just have fits this service membership requirements that will be set forth because of the the latest Company from Veterans Situations. You generated your property loan professionals through your federal shield services.

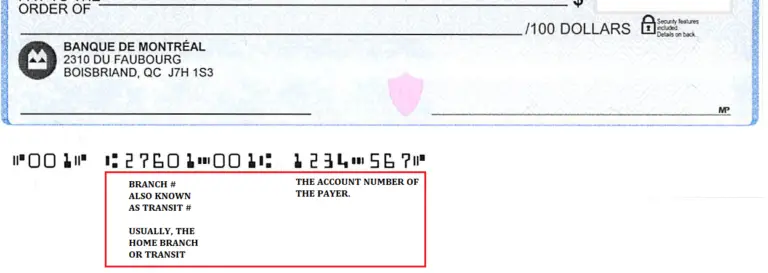

To help you get an effective Virtual assistant financial because the an effective person in new National Guard, you’ll want finished no less than six years of provider, come honorably released to own a service-associated handicap, or completed no less than ninety straight days of effective obligations services. This service membership criteria National Shield players have to meet so you can qualify for this new Va home loan system try intricate during the brand new lower than chart.

One of the trick popular features of the latest Va financial work with is you qualify since the a national Guard affiliate for folks who serve at the very least ninety days out-of energetic obligations provider. There are also particular tricky Virtual assistant statutes regarding the picked set-aside and term 32 commands that may help you meet the requirements. For many who did suffice regarding selected reserve or if you was indeed at the mercy of name thirty-two instructions, please label and we’ll help you find out if you qualify.

Military Federal Shield Va Loan Eligibility Requirements

When making an application for an excellent Va financial once the a national Protect member, it is essential to understand the different options available. Along with our versatile, educated, and compassionate features, HomePromise proudly also provides Federal Shield members an incredibly aggressive loan origination commission. Whatever the overall loan amount and/or sorts of loan, the HomePromise Va financing origination commission payday loans Cokedale was $590.

Phone call HomePromise at the 800-720-0250 to speak with our home loan professionals from the searching a no cost estimate and you may easily obtaining a beneficial Virtual assistant mortgage.

We are in need of Federal Shield users to have a complete understanding of the significant impression loan origination charges can have to the money owed within closing. Once you understand what is actually a good financing origination payment to pay might help save a little money when selecting your home. Specific loan providers charge around 0.5%-1% of your own overall loan amount (1% off an excellent 300,000 loan amount are $step 3,000), and some loan providers fees more than $step one,000 to have financing origination costs.

Although it might be appealing to work with a lender just who doesn’t charge people financing origination costs, the lending company will make you pay for it inside the different ways.

Thus, in the event you are not spending that loan origination commission during the closure, you are able to end purchasing almost every other highest charge or perhaps be purchasing more over the life span of financing because of your large interest. This may getting uncomfortable to blow more funds from the closing, nevertheless ount of money fundamentally getting a diminished interest rate.