Everything you need to find out about Lower Put Fund

As you may or may not know, taking a reduced-deposit mortgage having less than an effective 20% put is much more difficult and much more expensive!

However, most of the is not missing loans with a minimum ten% put are available, regardless of if these will set you back a great deal more inside the costs than simply pre-LVR constraints. Brand new builds are allowed to be during the ten% because they’re exempt throughout the Credit legislation, but you will still shell out significantly more for having this new advantage out of borrowing more than 80%.

Don’t forget, you’re entitled to a primary Financial or First Domestic Lover and therefore just demands a beneficial 5% deposit.

Why must I go having the lowest-deposit mortgage?

You’ve got protected $x and that translates to 10% out of something. You should buy into the possessions hierarchy. Yes, the loan payments would-be large, but no lender offers financing if you cannot solution installment loans online Minnesota financing. Services setting you pay from the income and you can proclaimed costs. At the beginning of a discussion which have home financing Adviser, that person often determine what you can provider. One to review are computed in the a higher level because of the In control Financing Code in NZ. We should instead always pays later if prices do increase, so that you is actually analyzed today at this higher level.

Costs having Low Deposit Loans

Once the securing away from reduced put loans, Banking companies and you may Lenders haven’t just improved charge and you will interest rates, however now also use application costs and no extended bring efforts to possess courtroom fees.

Just what charge are you up for?

- Reduced Guarantee Charges Lenders essentially create a great margin (LEM) into the rate of interest while more 80% credit. This may are normally taken for .25% to at least one.5% with regards to the financial. Certain banking institutions along with charge a low equity advanced (LEP) which comes in the form of an upfront fee based towards the the dimensions of the loan.

Courtroom Charge when it comes to Get These can are normally taken for solicitor so you can solicitor that it pays to look around. It certainly is good to become known a beneficial solicitor too.

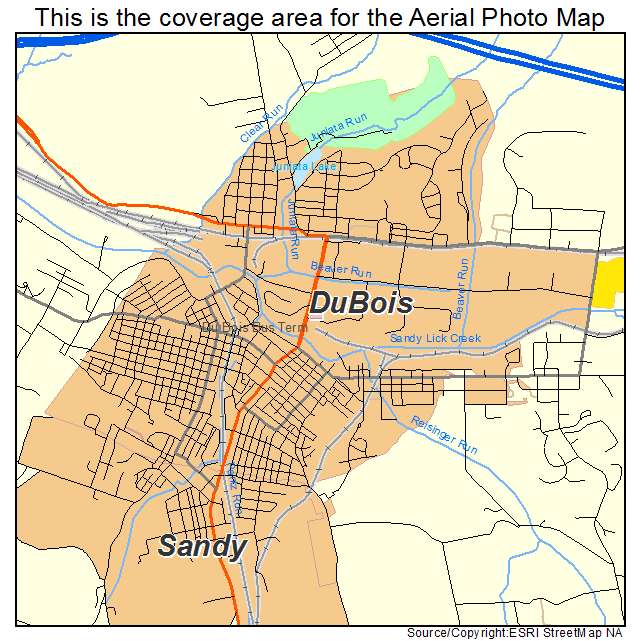

- Joined Valuation It is regular to have financial institutions in order to consult an excellent valuation to own attributes getting ordered having lower than 20% put. But in addition for individual conversion process. Valuations can vary out-of $850 right up with regards to the valuer, as well as the really worth, proportions, and located area of the assets. This will be bought because of the Financial Agent when they be aware of the lender you are using. You the consumer after that will pay for brand new valuation while the valuer goes and really does the fresh new valuation. The borrowed funds Adviser, the visitors, additionally the bank all of the score a duplicate of your valuation. If the property is another build, up coming an effective valuation called a certification out of Completion becomes necessary at the the end of new generate to demonstrate its 100% done. It is cheaper and that is a necessity regarding bank to help you finish the loan.

Achieving 80% credit

It’s all about precisely how your structure the loan should you get your house. Start of the performing it down to 85% credit, then added rate of interest decreases. Following get it down to 80% and after that you was where you while the financial need certainly to end up being in the 80% lending.

Therefore, when it comes to taking a loan having a low put it can pay to shop as much as, not only to see a lender whom offers reduced put finance, but also to find the best bargain.

So what is Low Collateral Fees and you will Margins all about?

Because of the high risk for banks of reduced put financing, he is necessary to pull out a creditors mortgage insurance coverage to reduce the risk. The reduced equity fee talks about the cost of that it insurance rates.

Suggestions for Getting to Yes’ for the financial getting funds that have less than 20% put

While it’s reasonable to say that it is difficult on the newest environment to track down that loan which have less than 20% put via a financial, you might still be able to get that for those who have a quite strong software. Getting a fighting opportunity, applicants might must fulfill the following criteria;

- Possess excellent credit score

- Ideally a saved deposit

- Have demostrated a financial administration and also have sophisticated account run (zero unauthorised overdrafts, dishonours)

- A great excessive away from fund just after all costs subtracted

- Very few debt

- Constant long-name a job/earnings